Join the NFRG Team

Full-time, growth-minded agents get structure, accountability, and a squad that has their back on every deal.

Apply as an AgentState-mandated consumer protection notice from the Texas Real Estate Commission.

Texas law requires all real estate license holders to provide this notice to prospective buyers, tenants, sellers, and landlords.

Brokered by LPT Realty, LLC | License No. 9012763-BB | Support@lptrealty.com | (877) 366-2213

Download the full official TREC disclosure form (PDF)

Download TREC Disclosure (PDF)This notice is provided for information purposes only and does not create an obligation to use our services.

Navy Fellas Realty Group blends real-world coaching, structure, and hands-on deal support so full-time agents can grow faster—while still serving serious buyers, sellers, and investors who want smooth, confident closings.

Full-time, growth-minded agents get structure, accountability, and a squad that has their back on every deal.

Apply as an AgentWeekly live calls, playbooks, and role-plays so you can turn more conversations into closings with confidence.

View CoachingSerious homebuyers, sellers, and investors get a responsive, battle-tested team guiding every step of the transaction.

Work With UsA national brokerage partner powering elite service, strong compliance, and next-level support.

Texas Information About Brokerage Services

This intro gives agents a quick look at our coaching culture, execution standard, and daily momentum.

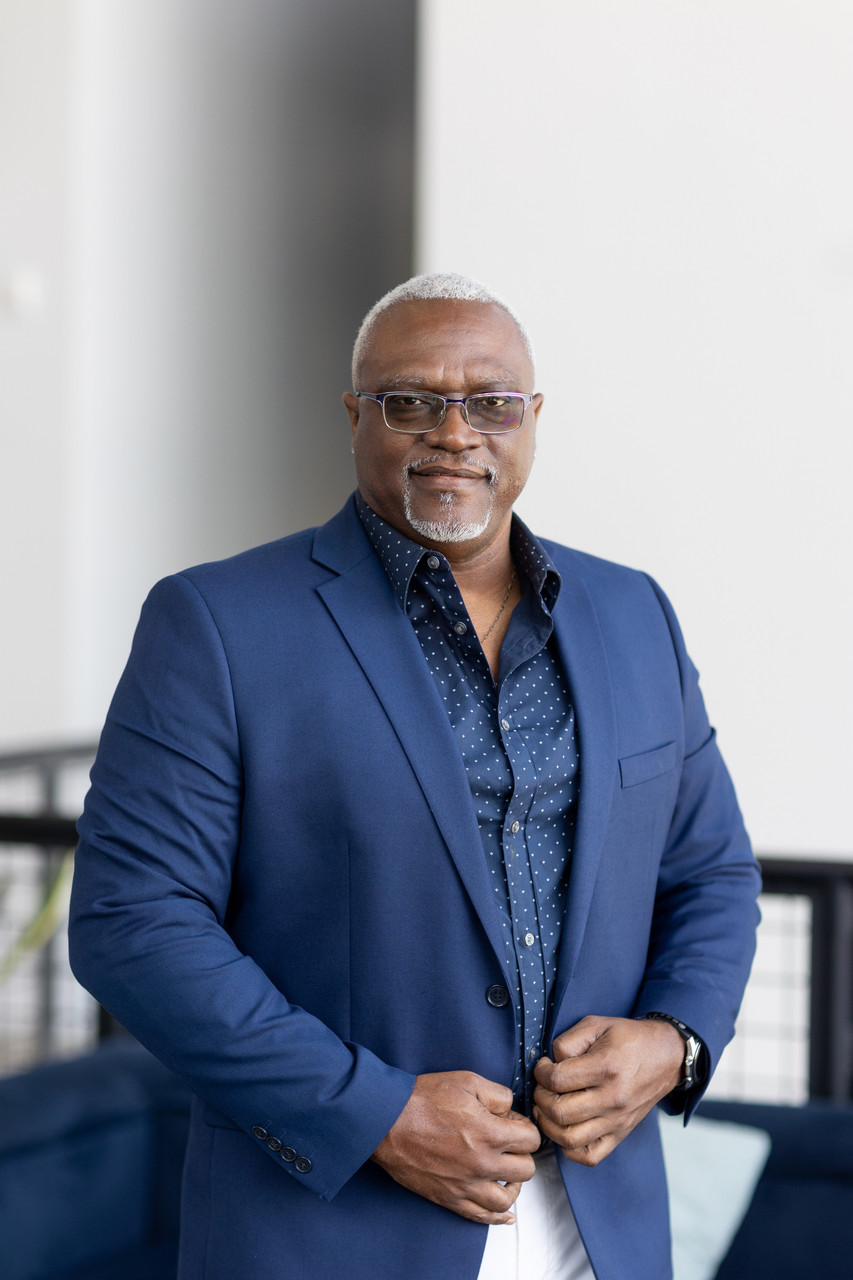

JAMES is a Houston-area native and licensed real estate professional since 2007. A 23-year U.S. Navy veteran, he brings the discipline, precision, and leadership of military service into every transaction. He also holds a BBA from UMUC.

As a prior active-duty service member, relocation is his specialty. James understands firsthand the pressure of finding a home in an unfamiliar area—because he has lived it. The questions you have are often the same questions he had to ask and overcome throughout his career.

Having experienced multiple relocations as a Navy Chief, James offers a unique perspective for both existing home purchases and new construction—guiding you with clarity, confidence, and a mission-first approach.

Proudly aligned with LPT Realty LLC to serve clients and fellow agents with professionalism and integrity.

Years of experience helping buyers and sellers navigate the Houston market with steady guidance and strong execution.

From first-time moves to major transitions, James helps you make confident decisions in a new area— with a process built from real-world relocation experience.

A 23-year U.S. Navy veteran and BBA graduate, James brings disciplined planning, clear communication, and a unique viewpoint for both existing homes and new construction.

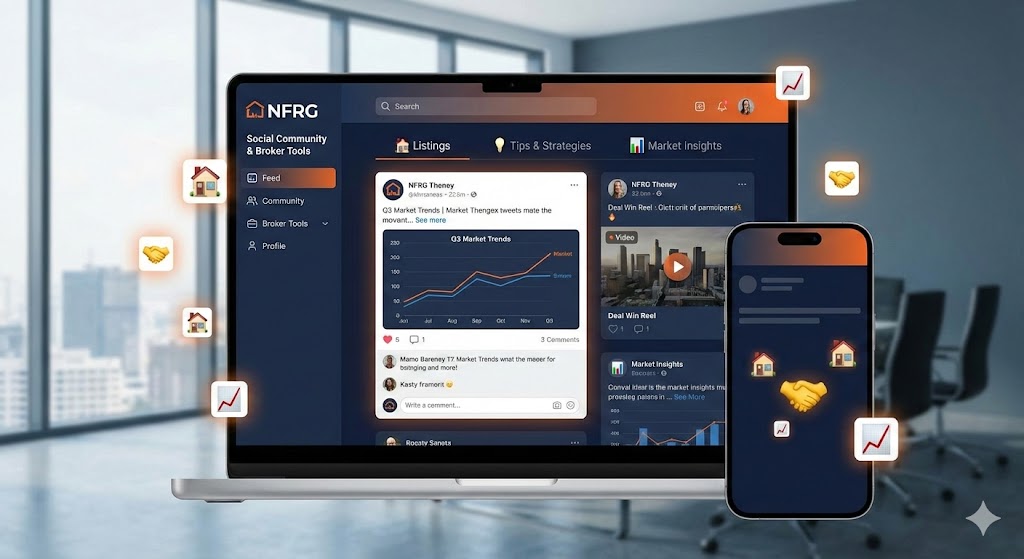

Built for serious agents who want direct mentorship, on-demand courses, webinars, tactical conversations, and broker tools in one place. Learn faster, post smarter, and grow together inside NFRG.

LinkedIn + Reddit style collaboration for real estate with mentor access and course-driven growth: post updates, share wins, ask questions, launch polls, drop short videos, tag members, and save key posts.

ASHLEY, originally born in Belize, Central America, currently resides in Cypress, TX with his wife, two kids, and a rescue dog named Labelle. After honorably serving nearly a decade in the United States Navy, he settled in the Houston area, completed his Bachelor of Business Administration degree, and has called Houston home for the past 20 years.

He stays connected to the community by keeping up with new developments, and he and his wife enjoy exploring both new and established dining and social spots across the area.

Combined with experience from the military and oil and gas industry, Ashley is passionate about helping others. He listens to client needs, provides trusted resources and information, and guides negotiations through each step of the buying and selling process.

Whether you are selling or purchasing the home that fits this stage of your life, Ashley is ready to deliver trustworthy, ethical, and committed service.

Nearly a decade of military service shaped a disciplined, mission-first approach to client communication and execution.

Twenty years in the Houston area with active local involvement and ongoing insight into neighborhood growth and market opportunities.

Built on real buying and selling experience, Ashley helps clients navigate emotional and complex decisions with clear, ethical support.

Connect with Navy Fellas Realty Group, proudly brokered by LPT Realty LLC, for client care, recruiting, or agent support.

14150 Huffmeister Rd Suite 125

Cypress, TX 77429

General: james.scott@navyfellasrealtygroup.com

Support & Billing: ashley.henkis@navyfellasrealtygroup.com