Selling your house can be both exciting and daunting, especially when you receive offers from potential buyers. It’s essential to evaluate each offer carefully to ensure you’re making the right decision. Here are three key factors to consider when evaluating an offer on your home:

Selling your house can be both exciting and daunting, especially when you receive offers from potential buyers. It’s essential to evaluate each offer carefully to ensure you’re making the right decision. Here are three key factors to consider when evaluating an offer on your home:

1. Price

The offered price for your home is not just a number but a critical determinant of your return on investment. While a higher offer may seem attractive at first glance, it’s crucial to compare it against recent market trends and the appraised value of your property. Sometimes, a lower but more solid offer may be preferable if it comes with fewer contingencies and a higher likelihood of closing smoothly. Additionally, consider the financial qualifications of the buyer. A buyer who is pre-approved for a mortgage or has demonstrated proof of funds is generally more likely to secure financing, reducing the risk of the deal falling through due to financial issues.

2. Speed

The timeline from offer acceptance to closing can vary significantly between buyers. Some may be ready to close within a few weeks, while others may need several months due to various reasons such as selling their current home or finalizing their financing. If you’re looking to sell quickly, prioritize offers that align with your desired timeline. However, be cautious of overly aggressive timelines that may indicate rushed financing or other potential risks. A balanced approach considers both your urgency to sell and the buyer’s ability to fulfill their commitments within a reasonable timeframe.

3. Certainty

Certainty refers to the likelihood that the sale will proceed smoothly without unexpected hurdles. Offers with fewer contingencies generally provide more certainty. Common contingencies include home inspection, appraisal, and the sale of the buyer’s current home. While these are standard practices designed to protect both parties, they can introduce delays and uncertainties in the transaction. Evaluate offers that minimize these contingencies while ensuring that your interests are still adequately protected. A well-qualified buyer with a solid financing plan and minimal contingencies is more likely to follow through on the purchase, giving you peace of mind during the closing process.

When evaluating offers on your house, take the time to carefully consider each factor: price, speed, and certainty. Assessing these elements holistically will help you make an informed decision that aligns with your financial goals and personal priorities. Remember, the “best” offer is not always the highest one on paper but the one that offers a balanced combination of price, favorable terms, and a high probability of closing successfully.

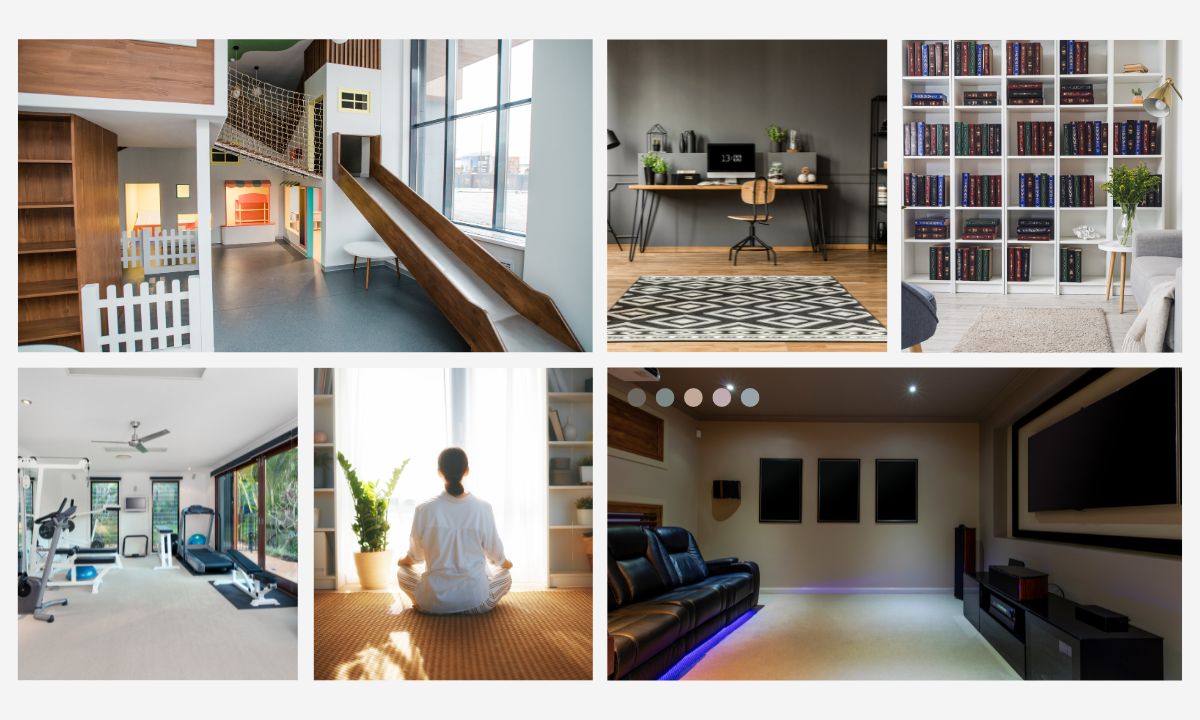

Have you found yourself staring at that spare room wondering what to do with it? Whether it’s a small nook or a spacious area, there are endless possibilities to transform it into something that enhances your home life. Here are some inspiring ideas to help you make the most of that extra space:

Have you found yourself staring at that spare room wondering what to do with it? Whether it’s a small nook or a spacious area, there are endless possibilities to transform it into something that enhances your home life. Here are some inspiring ideas to help you make the most of that extra space: This historic day commemorates the emancipation of enslaved African Americans in the United States, and it’s more relevant now than ever as we strive to promote diversity, equity, and inclusion in everything we do. Juneteenth, celebrated on June 19th each year, marks the day in 1865 when Union soldiers arrived in Galveston, Texas, bringing the news of freedom to the last remaining enslaved African Americans. It’s a poignant reminder of both the injustices of the past and the ongoing journey towards equality.

This historic day commemorates the emancipation of enslaved African Americans in the United States, and it’s more relevant now than ever as we strive to promote diversity, equity, and inclusion in everything we do. Juneteenth, celebrated on June 19th each year, marks the day in 1865 when Union soldiers arrived in Galveston, Texas, bringing the news of freedom to the last remaining enslaved African Americans. It’s a poignant reminder of both the injustices of the past and the ongoing journey towards equality. If you’re considering buying a home or refinancing your mortgage, you’ve probably come across the term “mortgage origination fee.” But what exactly is it? Let’s take a look at the details to help you understand what this fee entails and why it’s an important part of the mortgage process.

If you’re considering buying a home or refinancing your mortgage, you’ve probably come across the term “mortgage origination fee.” But what exactly is it? Let’s take a look at the details to help you understand what this fee entails and why it’s an important part of the mortgage process.

When it comes to buying a home, securing the right home loan is essential. But what determines how much you can borrow? Understanding the key factors that influence your borrowing power can help you make informed decisions and potentially increase the amount you can secure. Let’s explore these determinants and some actionable tips to maximize your borrowing power.

When it comes to buying a home, securing the right home loan is essential. But what determines how much you can borrow? Understanding the key factors that influence your borrowing power can help you make informed decisions and potentially increase the amount you can secure. Let’s explore these determinants and some actionable tips to maximize your borrowing power. Congratulations! You’ve received and accepted an offer on your home. This is a major milestone, but it’s not the end of the journey. Several steps and processes follow the acceptance of an offer, and understanding what to expect can help you navigate this phase smoothly. Here’s a detailed look at what comes next:

Congratulations! You’ve received and accepted an offer on your home. This is a major milestone, but it’s not the end of the journey. Several steps and processes follow the acceptance of an offer, and understanding what to expect can help you navigate this phase smoothly. Here’s a detailed look at what comes next: Deciding when to sell your home can be a daunting task. The housing market is unpredictable, and personal circumstances can add layers of complexity to the decision. If you’re contemplating selling your home but aren’t sure if the timing is right, here are some signs to help guide your decision.

Deciding when to sell your home can be a daunting task. The housing market is unpredictable, and personal circumstances can add layers of complexity to the decision. If you’re contemplating selling your home but aren’t sure if the timing is right, here are some signs to help guide your decision. Navigating the real estate market can be challenging, especially with all the industry-specific terms that get tossed around. Two phrases you’re likely to encounter are “pending” and “under contract.” While they might seem similar at first glance, they represent different stages of the home-buying process. Let’s break down what each term means and how they impact your home-buying or selling journey.

Navigating the real estate market can be challenging, especially with all the industry-specific terms that get tossed around. Two phrases you’re likely to encounter are “pending” and “under contract.” While they might seem similar at first glance, they represent different stages of the home-buying process. Let’s break down what each term means and how they impact your home-buying or selling journey.