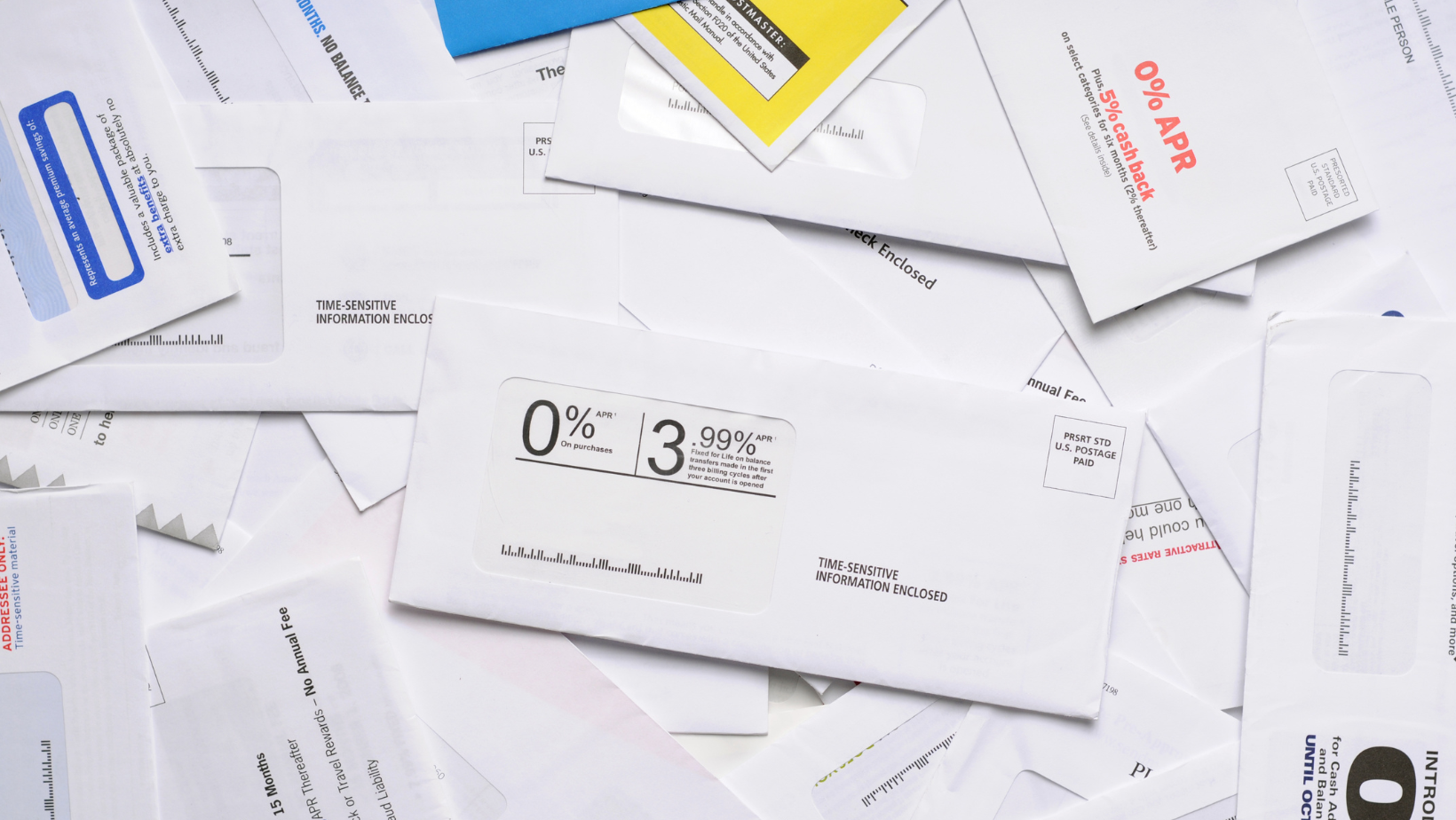

Congratulations! You have finally closed on your home loan, and you are excited to get moved in. Or, you may have just refinanced your home. Regardless, all of a sudden, you start to get a bunch of junk mail in your mailbox. It can be frustrating to sort through everything, and how did they get your information in the first place?

Where Junk Mailers Get Your Personal Information

First, there are a few locations where junk mailers may have gotten your personal information. Once your property deed is recorded, it goes into the public record. Anyone who goes into the public record can find your name, the name of your lender, your loan amount, and your address. This is what they use to send you junk mail, and it is why you get flooded with a bunch of mail as soon as you close on a home loan.

Always Check Your Mail Before Shredding It

Even though you are going to receive a lot of junk, some of it is going to have your personal information listed on it. You should always check to see if your personal information is printed on the mail, and if it is, go ahead and shred it. On the other hand, you must make sure you do not throw out anything important. For example, there might be a note about property taxes, or there might be information related to changes in your loan. Always screen your mail before you shred it.

Can You Stop The Junk Mail?

It is unlikely that you will be able to stop the junk mail completely. On the other hand, there are a few locations where you might be able to opt out of some of this junk mail. If you put yourself on the do not mail registry, you may be able to reduce the amount of junk mail you receive.

Talk To A Professional To Learn More

You need to understand exactly what is happening with your home loan before you close, and that is why you should reach out to an expert who can help you. They might even be able to provide you with some advice regarding how you can stop the junk mail from coming in.

Last week’s economic reporting included readings on new and pending home sales, inflation, and consumer sentiment. Weekly readings on mortgage rates and jobless claims were also released.

Last week’s economic reporting included readings on new and pending home sales, inflation, and consumer sentiment. Weekly readings on mortgage rates and jobless claims were also released. Members of the military, their family members, and veterans have access to a unique mortgage option called a VA loan. This can be a strong option because it provides borrowers with an opportunity to purchase a house for less than 20 percent down. While not everyone is eligible for a VA loan, there are a lot of people who are wondering, are VA loans assumable? There are a few key points to keep in mind.

Members of the military, their family members, and veterans have access to a unique mortgage option called a VA loan. This can be a strong option because it provides borrowers with an opportunity to purchase a house for less than 20 percent down. While not everyone is eligible for a VA loan, there are a lot of people who are wondering, are VA loans assumable? There are a few key points to keep in mind. Are you in the market for a new house? If so, you might be thinking about building your own house. It can be exciting to go through the process of building a house, as you will be in control of just about everything. On the other hand, how much is it going to cost you to build a house? You need to make sure you have an estimate before you decide to move forward with your project.

Are you in the market for a new house? If so, you might be thinking about building your own house. It can be exciting to go through the process of building a house, as you will be in control of just about everything. On the other hand, how much is it going to cost you to build a house? You need to make sure you have an estimate before you decide to move forward with your project.  If you are thinking of buying a condominium or a home that is part of a planned community, you have likely come across the term “homeowners’ association” or HOA. In short, the HOA is a coalition of local homeowners who have banded together to manage the needs of the local community. Let’s explore the concept of the homeowners’ association, why they charge fees and what you can expect from your HOA if you buy a home that is part of one.

If you are thinking of buying a condominium or a home that is part of a planned community, you have likely come across the term “homeowners’ association” or HOA. In short, the HOA is a coalition of local homeowners who have banded together to manage the needs of the local community. Let’s explore the concept of the homeowners’ association, why they charge fees and what you can expect from your HOA if you buy a home that is part of one. Are you interested in purchasing a rental property? Instead of buying a new one, you might want to convert your primary residence into a rental property, particularly if you plan on moving in the near future. At the same time, you might think it is better to sell the property and take the cash instead. Which option is best for you?

Are you interested in purchasing a rental property? Instead of buying a new one, you might want to convert your primary residence into a rental property, particularly if you plan on moving in the near future. At the same time, you might think it is better to sell the property and take the cash instead. Which option is best for you?

There is a good chance you have heard someone described as being house poor. What exactly does it mean? It is important to understand what it means to be house poor and how you can stay away from it.

There is a good chance you have heard someone described as being house poor. What exactly does it mean? It is important to understand what it means to be house poor and how you can stay away from it. There are not many parts of your life that are private anymore. Today, it is relatively easy for someone to go online and look up your address in just a few minutes. At the same time, there are some people who have an easier time keeping their lives private. Celebrities, public officials, and other people who are frequently in the public light are able to conceal their addresses. Even if you aren’t famous, what do you need to do to hide your address?

There are not many parts of your life that are private anymore. Today, it is relatively easy for someone to go online and look up your address in just a few minutes. At the same time, there are some people who have an easier time keeping their lives private. Celebrities, public officials, and other people who are frequently in the public light are able to conceal their addresses. Even if you aren’t famous, what do you need to do to hide your address?