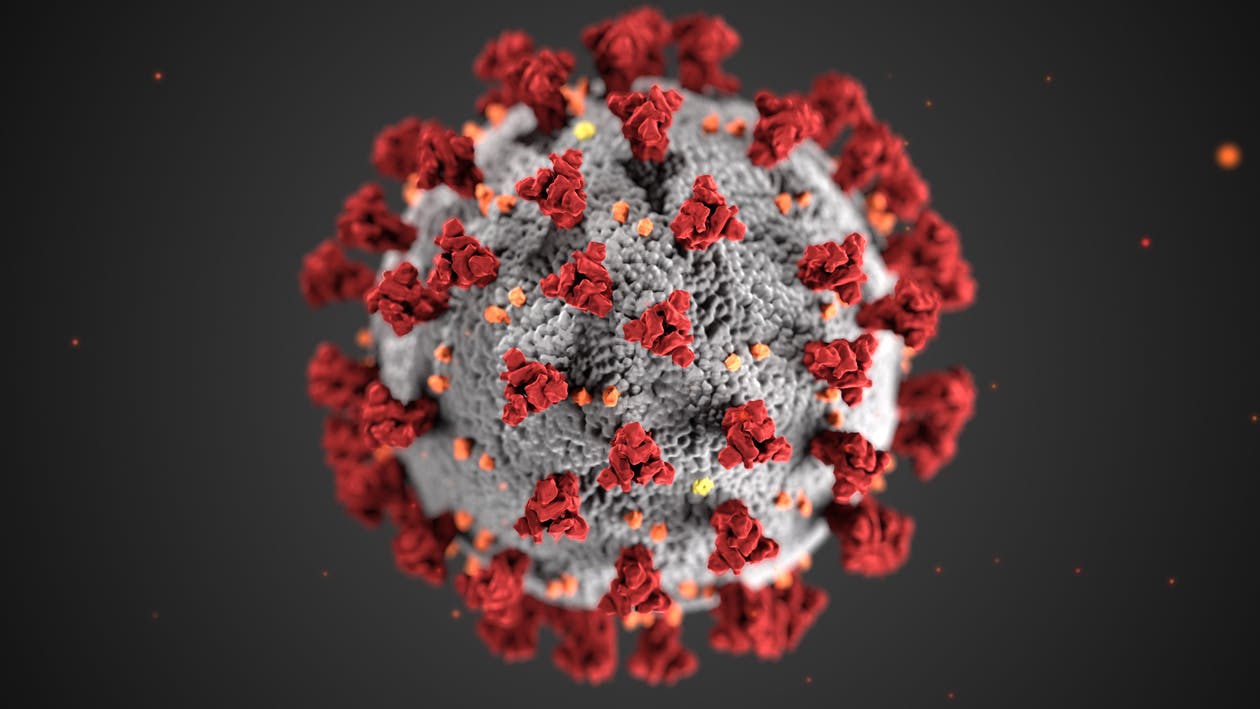

If you have paid attention to the news recently, you have probably heard about the coronavirus pandemic which also goes by the name COVID-19. Those who are exposed to the virus might be asked to place themselves in quarantine. Some states have even told their residents to shelter in place. While this infection has forced everyone to change the way they live their lives, there are still some home improvement projects you can tackle during quarantine to put your free time to use.

If you have paid attention to the news recently, you have probably heard about the coronavirus pandemic which also goes by the name COVID-19. Those who are exposed to the virus might be asked to place themselves in quarantine. Some states have even told their residents to shelter in place. While this infection has forced everyone to change the way they live their lives, there are still some home improvement projects you can tackle during quarantine to put your free time to use.

Jump On Spring Cleaning

One of the first home improvement projects people need to tackle is spring cleaning. Spring is right around the corner so it is time to sort through items that aren’t needed anymore. Start with the wardrobe closet and figure out what is going to be worn during the warmer months, what can be put into storage, and what can be donated. Then, move to the kitchen. Take a look at the drawers and see if there is anything that can be put away. Try to pull out the separators can clean the drawers as well. Finally, move to the living room and declutter anything that isn’t needed anymore. This is going to make the home feel more open, which is important during quarantine.

Repurpose A Room In The Home For A Gym

If you or your family are going to miss going to the gym, it is time to repurpose a room to act as an indoor space to exercise. Think about using the bonus room or basement as an athletic area. Furthermore, you can even save money on gym costs. Try to move chairs and coffee tables out of the way. If possible, put down some rubber flooring, an old mat, or even a few towels to prevent from staining the rug. If you are going to use a jump rope, make sure that nothing valuable is in the way. Try to shift items to make plenty of space for push-ups, sit-ups, jump rope, and free weights.

Home Improvement During Quarantine

It is important for people to follow the advice of medical professionals during the pandemic. Being quarantined is not an ideal situation, but these are only a few of many home improvement projects that can be accomplished during your time at home.

Last week’s economic reports were limited due to closures connected with coronavirus regulations. The Federal Reserve did not issue minutes for the most recent Federal Open Market Committee meeting as the meeting was canceled.

Last week’s economic reports were limited due to closures connected with coronavirus regulations. The Federal Reserve did not issue minutes for the most recent Federal Open Market Committee meeting as the meeting was canceled. It can be a tremendous challenge to suddenly be stuck at home during the COVID-19 crisis. For those who are in an area of the country where there is a “shelter in place” order, this can feel very much like house arrest. If there are children stuck at home as well, this could be enough to make the entire family go stir crazy.

It can be a tremendous challenge to suddenly be stuck at home during the COVID-19 crisis. For those who are in an area of the country where there is a “shelter in place” order, this can feel very much like house arrest. If there are children stuck at home as well, this could be enough to make the entire family go stir crazy. By now, it should be apparent that this COVID-19 (Corona-virus) pandemic is going to be here for several months. It is already causing the market to plummet and is disrupting jobs all over the country. Many people who work as hourly employees (or are independent contractors) are starting to suffer. As people’s budgets start to feel the squeeze, this is exactly the time that people should be relying on an emergency fund; however, for those who don’t have one, it is time to start saving.

By now, it should be apparent that this COVID-19 (Corona-virus) pandemic is going to be here for several months. It is already causing the market to plummet and is disrupting jobs all over the country. Many people who work as hourly employees (or are independent contractors) are starting to suffer. As people’s budgets start to feel the squeeze, this is exactly the time that people should be relying on an emergency fund; however, for those who don’t have one, it is time to start saving. Federal housing agencies and government-sponsored enterprises Fannie Mae and Freddie Mac are responding to the COVID-19 outbreak with multiple relief programs for homeowners experiencing hardship due to illness and job loss.

Federal housing agencies and government-sponsored enterprises Fannie Mae and Freddie Mac are responding to the COVID-19 outbreak with multiple relief programs for homeowners experiencing hardship due to illness and job loss. Last week’s economic reporting included readings on pending home sales, Case-Shiller Home Price Indices, and Bureau of Labor Statistics reports on national unemployment. Weekly readings on mortgage rates and first-time jobless claims were also released.

Last week’s economic reporting included readings on pending home sales, Case-Shiller Home Price Indices, and Bureau of Labor Statistics reports on national unemployment. Weekly readings on mortgage rates and first-time jobless claims were also released.