Knowing the difference between a hard inquiry vs soft inquiry can help you maintain a good credit score. Here’s what you need to know.

Knowing the difference between a hard inquiry vs soft inquiry can help you maintain a good credit score. Here’s what you need to know.

Most people know that your credit score can drop if you miss a payment or have a new collection filed against you. But how about when you apply for new credit? Yes, a credit application will trigger a “hard inquiry” on your report, which can have an impact on your credit score. Here’s what to know about hard inquiries, and how they compare with “soft inquiries.”

What is a Hard Inquiry?

Hard inquiries occur when you apply for credit and consent to allow a lender to check your credit report. These inquiries dated within the past 12 months count toward 10% of your credit scores even though 24-months of inquiry history is retained in your credit report.

Hard inquiries are listed by date and include the lender’s name and the name of the third-party credit provider that provided the report to the lender.

Examples of hard inquiries include:

- Applying for a car loan and the dealer checks your credit report

- Applying for a new credit card

- Requesting to have the credit limit increased on an existing credit card

- Applying for a mortgage

- Applying to lease an apartment

Only authorized parties are allowed to access your credit report, and to do so, they must have a permissible purpose. Lenders only have permissible purpose if you have applied for credit and given the potential lender consent to check your credit report. Hard inquiries made for any other reason without your consent are not permissible and you have the right to dispute any unauthorized inquiries.

How Many Points Does a Hard Inquiry Affect Your Credit Score?

According to credit experts, “In most cases, a hard inquiry from a lender will decrease your scores by 7 points or less. The highest drop in scores that I’ve seen was 23 points, but that is very rare.”

The impact of applying for credit will differ from person to person based on their unique credit history. Individuals with very little or no credit history may see a bigger drop in scores compared to someone who has established credit and who has proven to manage more accounts over time.

It is true that in most cases, an occasional hard inquiry will have little to no impact on your credit scores. However, a new hard inquiry can lower your score by a few points when certain factors come together in your credit report:

- Opening a new credit card or line of credit will affect your length of credit history because it lowers the average age of your total accounts. This, in turn, will lower your length of credit history and subsequently, will lower your credit scores.

- New credit, once used, will increase the “amounts owed/credit utilization” factor of your credit scores and may also contribute to lowering your scores.

Minimize the Impact of a Hard Inquiry on Your Credit Score

To minimize the impact on your score, do your rate shopping within a focused amount of time. Most credit scores are not affected by multiple inquiries from the same type of creditor within a short period of time.

Credit score models have been programmed to accommodate typical “rate shopping periods” for auto, mortgage, or student loans. This means that if you are looking to buy a new automobile, conduct your comparison shopping among multiple dealers and creditors within a 30-day average period. Then, multiple hard credit inquiries from auto lenders will only count as a single hard inquiry for credit scoring purposes.

Hard inquiries count toward the calculation of your credit scores, so it’s important to monitor your inquiries. Make sure that you know who, when, and why a creditor has reviewed a copy of your credit report. If you notice hard inquiries in your credit report that you do not recognize, it’s important to find out more about them by using the information in your report and disputing the inquiries. You can learn more about how to dispute inaccuracies in your credit report by visiting the FTC’s website.

How to Check for Hard Inquiries

The next time you apply for new credit, you’d be wise to obtain and review your credit report. Or, get a free report at annualcreditreport.com, a federally-mandated website that gives you a free report from each of the three major credit bureaus. In your report, you’ll see a list of the creditors and lenders who have checked your credit file over the past 24 months. These credit checks by creditors and lenders are called “inquiries.”

But not all inquiries are created equal — hard inquiries and soft inquiries have different effects on your credit score.

What is a Soft Inquiry?

Soft inquiries are checks of your credit report that are not associated with your credit application. They do not impact your credit scores in any way.

Examples of soft inquiries might include any of the following:

- Checking your credit report and credit scores through an organization authorized to provide credit reports to consumers

- Applying for a job

- Receiving prescreened offers of credit from credit card companies, insurers, and other creditors

Hard Inquiry vs. Soft Inquiry: Rule of Thumb

If you’re not applying for credit, you won’t incur a hard inquiry. So you don’t need to worry about dragging down your credit score by signing up for an app or service that helps you monitor your credit.

That being said, don’t be afraid to apply for credit if you need it. The impact on your score is typically small if you are not applying for many kinds of credit within a short time.

Homeowners and buyers are always looking for ways to finance their home improvement projects. Renovation loans offer a fantastic solution, enabling you to upgrade and personalize your home while incorporating the cost into your mortgage. We will explore the different renovation loan options available, such as FHA 203(k) and Fannie Mae HomeStyle, to see how they can help you achieve your dream home.

Homeowners and buyers are always looking for ways to finance their home improvement projects. Renovation loans offer a fantastic solution, enabling you to upgrade and personalize your home while incorporating the cost into your mortgage. We will explore the different renovation loan options available, such as FHA 203(k) and Fannie Mae HomeStyle, to see how they can help you achieve your dream home. Embarking on the journey to homeownership is an exciting milestone, but it also requires careful financial planning. One crucial aspect is managing your debt effectively. I want to ensure you have the tools and knowledge to navigate this process smoothly. Let’s discuss some essential strategies for managing your debt while purchasing a home.

Embarking on the journey to homeownership is an exciting milestone, but it also requires careful financial planning. One crucial aspect is managing your debt effectively. I want to ensure you have the tools and knowledge to navigate this process smoothly. Let’s discuss some essential strategies for managing your debt while purchasing a home. Have you ever heard of house hacking? It’s a real estate strategy that allows you to live in a property while renting out part of it to generate income. This approach helps offset your living expenses and can even pave the way to financial independence. Here’s a breakdown of what house hacking entails, along with its benefits and drawbacks.

Have you ever heard of house hacking? It’s a real estate strategy that allows you to live in a property while renting out part of it to generate income. This approach helps offset your living expenses and can even pave the way to financial independence. Here’s a breakdown of what house hacking entails, along with its benefits and drawbacks.

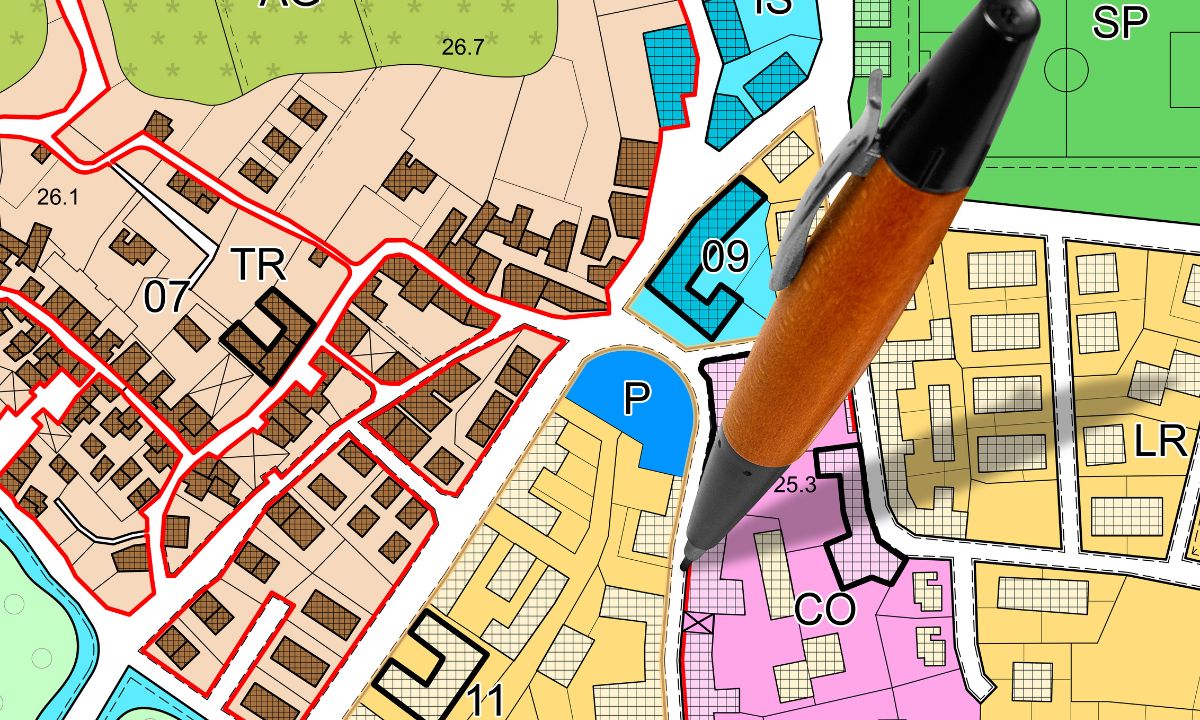

Purchasing a home is an exciting milestone, but it’s important to be aware of the various factors that can influence your decision. One often overlooked yet crucial aspect is understanding zoning laws and regulations. These rules can significantly impact your property rights and the future use of your home. We will discuss what zoning laws are, why they matter, and how they can affect your homebuying experience.

Purchasing a home is an exciting milestone, but it’s important to be aware of the various factors that can influence your decision. One often overlooked yet crucial aspect is understanding zoning laws and regulations. These rules can significantly impact your property rights and the future use of your home. We will discuss what zoning laws are, why they matter, and how they can affect your homebuying experience.