Navigating the world of real estate investment can be complex, but one of the most valuable tools for savvy investors is the 1031 exchange. Named after Section 1031 of the Internal Revenue Code, this strategy allows investors to defer capital gains taxes on the sale of an investment property by reinvesting the proceeds into a similar property. Here’s a breakdown of what you need to know about the 1031 exchange.

Navigating the world of real estate investment can be complex, but one of the most valuable tools for savvy investors is the 1031 exchange. Named after Section 1031 of the Internal Revenue Code, this strategy allows investors to defer capital gains taxes on the sale of an investment property by reinvesting the proceeds into a similar property. Here’s a breakdown of what you need to know about the 1031 exchange.

What is a 1031 Exchange?

A 1031 exchange, also known as a like-kind exchange, is a swap of one investment property for another that allows capital gains taxes to be deferred. The IRS defines like-kind properties as those of the same nature or character, even if they differ in grade or quality. This means you can exchange an apartment building for a retail space, for example, as long as both are held for investment purposes.

Key Benefits

Tax Deferral

The primary advantage of a 1031 exchange is the deferral of capital gains taxes, which can be significant. Instead of paying taxes on the profit from a property sale, investors can reinvest the full amount, enhancing their purchasing power.

Portfolio Diversification

1031 exchanges allow investors to diversify their portfolios by exchanging one type of property for another. This flexibility can help manage risk and optimize investment returns.

Wealth Accumulation

By deferring taxes and continuously reinvesting, investors can accumulate more wealth over time. The deferred taxes can essentially act as an interest-free loan from the government.

Essential Rules and Requirements

Like-Kind Properties

To qualify for a 1031 exchange, the properties involved must be like-kind. The definition of like-kind is broad, covering most real estate used for business or investment purposes.

Investment or Business Use

Both properties involved in the exchange must be held for productive use in a trade, business, or investment. Personal residences do not qualify.

Identification Period

The replacement property must be identified within 45 days of the sale of the relinquished property. This period is crucial and non-negotiable.

Exchange Period

The replacement property must be purchased within 180 days of the sale. These timelines run concurrently, not consecutively, so careful planning is essential.

Qualified Intermediary

A 1031 exchange requires the use of a qualified intermediary (QI). The QI holds the proceeds from the sale of the relinquished property and uses them to purchase the replacement property, ensuring that the investor never takes possession of the cash.

Title and Taxpayer

The same taxpayer that sells the relinquished property must purchase the replacement property. This means that if a property is sold by an LLC, the new property must also be bought by the same LLC.

No “Boot”

If the replacement property is of lesser value than the relinquished property, the difference (known as “boot”) is taxable. To avoid paying taxes, the replacement property must be of equal or greater value.

Potential Pitfalls

Tight Timelines

The 45-day identification and 180-day exchange periods can be challenging, particularly in a hot real estate market. Failing to meet these deadlines can disqualify the exchange.

Market Risks

There is always a risk that the replacement property could decline in value or that the investor might not find a suitable replacement within the given timeframe.

Complexity and Costs

1031 exchanges can be complex and often require professional assistance from real estate agents, attorneys, and tax advisors. Additionally, there are fees associated with using a qualified intermediary.

The 1031 exchange is a powerful tool for real estate investors looking to defer taxes and grow their portfolios. However, it requires careful planning, a thorough understanding of the rules, and professional guidance to navigate successfully.

By keeping these key points in mind, you can make informed decisions and take full advantage of the benefits that 1031 exchanges offer.

When it comes to protecting one of your most significant investments—your home—having the right insurance coverage is essential. Home insurance, also known as homeowners’ insurance, offers financial protection against a wide range of potential risks, from natural disasters to theft. However, not all home insurance policies are created equal. Understanding the different types of home insurance coverage can help you make an informed decision that best suits your needs. We will touch on the various types of home insurance coverage available and what each one entails.

When it comes to protecting one of your most significant investments—your home—having the right insurance coverage is essential. Home insurance, also known as homeowners’ insurance, offers financial protection against a wide range of potential risks, from natural disasters to theft. However, not all home insurance policies are created equal. Understanding the different types of home insurance coverage can help you make an informed decision that best suits your needs. We will touch on the various types of home insurance coverage available and what each one entails. Do you have a list of home projects you’ve been meaning to tackle? The good news: some of them can be done in just ten minutes! Here are five quick and easy tasks to help you get your home in order almost instantly.

Do you have a list of home projects you’ve been meaning to tackle? The good news: some of them can be done in just ten minutes! Here are five quick and easy tasks to help you get your home in order almost instantly.

Selling your house can be both exciting and daunting, especially when you receive offers from potential buyers. It’s essential to evaluate each offer carefully to ensure you’re making the right decision. Here are three key factors to consider when evaluating an offer on your home:

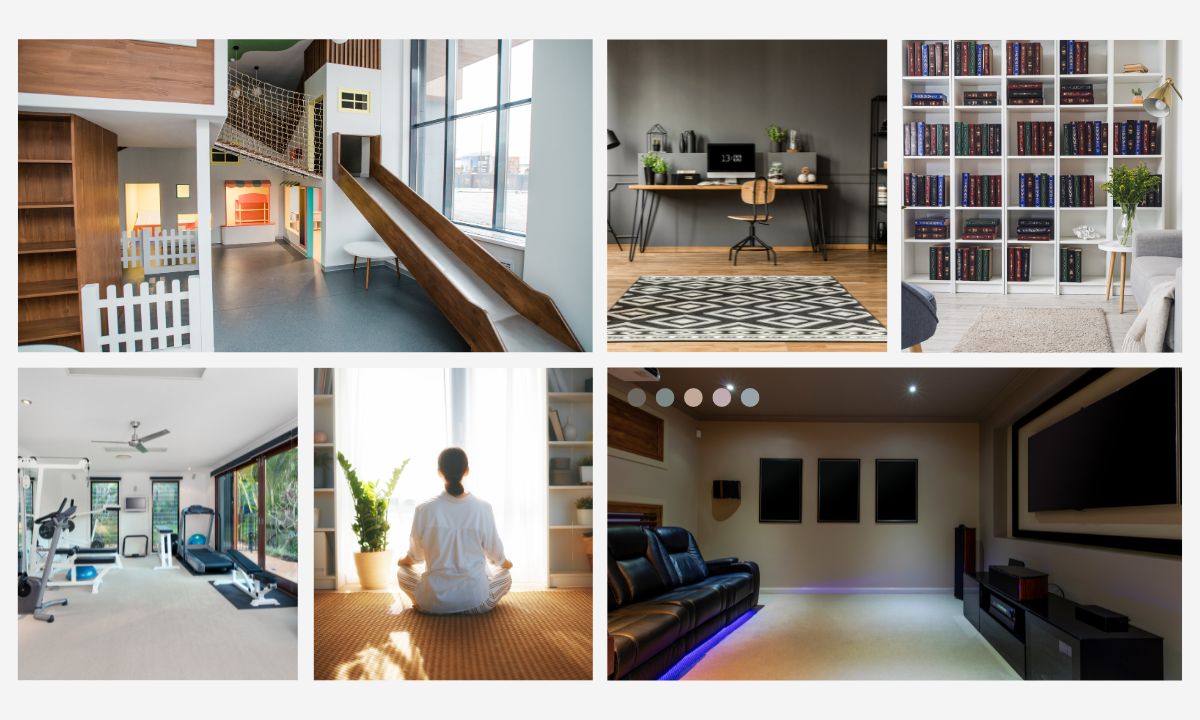

Selling your house can be both exciting and daunting, especially when you receive offers from potential buyers. It’s essential to evaluate each offer carefully to ensure you’re making the right decision. Here are three key factors to consider when evaluating an offer on your home: Have you found yourself staring at that spare room wondering what to do with it? Whether it’s a small nook or a spacious area, there are endless possibilities to transform it into something that enhances your home life. Here are some inspiring ideas to help you make the most of that extra space:

Have you found yourself staring at that spare room wondering what to do with it? Whether it’s a small nook or a spacious area, there are endless possibilities to transform it into something that enhances your home life. Here are some inspiring ideas to help you make the most of that extra space: