When buying or selling a home, a crucial step in the process is the home appraisal. It helps determine the property’s fair market value, which can significantly influence financing and negotiation outcomes. Whether you’re a first-time homebuyer or a seasoned seller, understanding the appraisal process is key. Here are seven commonly asked questions about home appraisals to guide you through.

When buying or selling a home, a crucial step in the process is the home appraisal. It helps determine the property’s fair market value, which can significantly influence financing and negotiation outcomes. Whether you’re a first-time homebuyer or a seasoned seller, understanding the appraisal process is key. Here are seven commonly asked questions about home appraisals to guide you through.

1. What is a Home Appraisal? A home appraisal is an unbiased estimate of a property’s value conducted by a licensed appraiser. Lenders require an appraisal to ensure the home is worth the loan amount being requested. The appraiser assesses factors like the home’s condition, location, and comparable sales in the area to determine its value.

2. Who Pays for the Appraisal? Typically, the buyer is responsible for paying the appraisal fee, which is often included in the closing costs. However, in some cases, the seller might cover the cost as part of the negotiation. The fee can vary depending on the property’s location and size but generally ranges between $300 and $600.

3. How Long Does an Appraisal Take? The appraisal process can take anywhere from a few days to a week. The appraiser will visit the property, take notes, and compare it with similar homes in the area. After the visit, the appraiser compiles the information into a report, which is then submitted to the lender.

4. What Factors Affect the Appraisal Value? Several factors influence the appraisal value of a home, including:

- Location: Proximity to schools, parks, and amenities can boost value.

- Size: Larger homes generally appraise for more.

- Condition: Updated, well-maintained properties are valued higher.

- Market Trends: Current real estate market conditions in the area also play a role.

5. What Happens if the Appraisal is Lower Than the Offer? If the appraisal comes in lower than the agreed-upon sale price, it can complicate the transaction. The buyer may need to renegotiate the price with the seller, come up with additional funds to cover the difference, or in some cases, the deal might fall through.

6. Can You Challenge a Low Appraisal? Yes, it’s possible to challenge a low appraisal, but it can be a complex process. The buyer or seller would need to provide evidence that the appraiser overlooked key aspects of the property or made errors in their report. This might involve presenting comparable sales that were not considered in the original appraisal.

7. Do Renovations Increase Appraisal Value? Renovations can increase a home’s appraised value, particularly if they improve the property’s functionality or appeal. Kitchens, bathrooms, and curb appeal upgrades tend to yield the highest return on investment. However, not all renovations guarantee a higher appraisal, so it’s essential to understand which improvements are most valued in your market.

Understanding the home appraisal process can help you navigate your real estate transaction more effectively. By knowing what to expect and how to address potential issues, you can ensure that the appraisal aligns with your goals and helps move the process forward smoothly.

Are you considering purchasing a property governed by a Homeowners Association (HOA)? If so, you’ve probably come across the term “HOA fees.” What exactly are these fees, who pays them, and why are they necessary?

Are you considering purchasing a property governed by a Homeowners Association (HOA)? If so, you’ve probably come across the term “HOA fees.” What exactly are these fees, who pays them, and why are they necessary?  So, you’ve decided to take the plunge into homeownership – congratulations! One of the most critical aspects of buying a home is figuring out your down payment. It’s a significant financial commitment that can shape your home-buying journey. But fear not! There are various down payment options available to suit different financial situations and goals. Let’s explore them together.

So, you’ve decided to take the plunge into homeownership – congratulations! One of the most critical aspects of buying a home is figuring out your down payment. It’s a significant financial commitment that can shape your home-buying journey. But fear not! There are various down payment options available to suit different financial situations and goals. Let’s explore them together. Home is where the heart is, and it’s also where you should feel the safest. Ensuring the security of your home has never been more attainable. Home security systems have evolved from simple locks and alarms to sophisticated, interconnected networks that provide round-the-clock protection. We will explore the latest innovations and timeless strategies to keep your home safe and secure.

Home is where the heart is, and it’s also where you should feel the safest. Ensuring the security of your home has never been more attainable. Home security systems have evolved from simple locks and alarms to sophisticated, interconnected networks that provide round-the-clock protection. We will explore the latest innovations and timeless strategies to keep your home safe and secure. When it comes to mortgages, a “buydown” generally refers to paying an extra fee upfront to reduce the interest rate over a specific period. There are typically two types: temporary buydowns and permanent buydowns.

When it comes to mortgages, a “buydown” generally refers to paying an extra fee upfront to reduce the interest rate over a specific period. There are typically two types: temporary buydowns and permanent buydowns. Kitchen remodeling projects can be exciting, but they also require careful planning and execution to avoid common mistakes that can lead to disappointment or costly errors.

Kitchen remodeling projects can be exciting, but they also require careful planning and execution to avoid common mistakes that can lead to disappointment or costly errors.  Home renovations can be an effective way to protect your home and family from natural hazards. Start by identifying the potential hazards in your area. This can include natural disasters such as earthquakes, hurricanes, floods, wildfires, and tornadoes, as well as man-made hazards such as gas leaks and fires. Once you’ve identified the potential hazards in your area, create a plan for how you will respond to them and prepare your home to take on these natural disasters and keep your home and family safe.

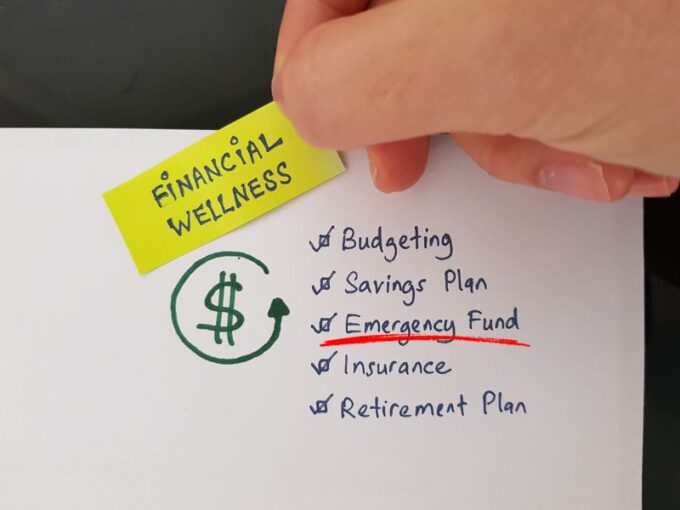

Home renovations can be an effective way to protect your home and family from natural hazards. Start by identifying the potential hazards in your area. This can include natural disasters such as earthquakes, hurricanes, floods, wildfires, and tornadoes, as well as man-made hazards such as gas leaks and fires. Once you’ve identified the potential hazards in your area, create a plan for how you will respond to them and prepare your home to take on these natural disasters and keep your home and family safe. It’s important to be financially prepared for emergencies so that you can handle unexpected expenses or situations without having to worry about your financial stability. Here are some ways to financially prepare for emergencies:

It’s important to be financially prepared for emergencies so that you can handle unexpected expenses or situations without having to worry about your financial stability. Here are some ways to financially prepare for emergencies: Getting a mortgage can potentially help your credit score, as long as you make your payments on time and in full each month. Payment history is one of the most important factors that influence your credit score, so consistently making your mortgage payments on time can have a positive impact on your credit score over time.

Getting a mortgage can potentially help your credit score, as long as you make your payments on time and in full each month. Payment history is one of the most important factors that influence your credit score, so consistently making your mortgage payments on time can have a positive impact on your credit score over time.