From small touches such as new lighting to larger efforts such as tiling the porch or stoop, creating curb appeal is one of the best investments you can make to resell your home fast.

From small touches such as new lighting to larger efforts such as tiling the porch or stoop, creating curb appeal is one of the best investments you can make to resell your home fast.

Here are eight ideas to maximize curb your appeal.

Landscaping Is Critical For The First Impression

- Cut Back Trees and Shrubs. Landscaping should enhance your house, not overwhelm it. Trimming can bring impressive results. If you don’t have a steady hand, leave it to a professional or handy relative.

- Manicure Your Lawn. A freshly mowed lawn is a must the week before a showing. Be sure to trim and edge it for a finished look that increases your curb appeal.

- Plant Some Color. If the weather permits, flowering plants are a cheap way to brighten the walkway leading up to your front door. It also gives the home a fresh vibe. Adding fresh mulch to your flower beds is a great quick fix, even in colder weather.

Don’t Forget Your Home’s Exterior

- Paint the House. If you can’t afford to paint the whole house and the exterior paint is in good condition, consider retouching the trim. The gives your home a sense of newness. If the exterior colors are outdated, painting the home should be a budget priority.

- Clean the Roof and Gutters. If anything is likely to attract a buyer’s attention, it’s clogged gutters, tree branches brushing the roof and algae growth. If you’re in a drier climate, make sure you don’t have obvious roof damage or missing tiles. If you need to replace the roof, it’s better to get it over with. Chances are, you’ll make up the money with a faster sale at a higher price.

- Clean the Walks and Driveway. Pressure wash patios, drives and walkways. Put fresh sealant on black-top driveways for a like-new boost to one of the areas buyers notice first.

Spruce Up The Outdoor Areas

- Make Outdoor Living Space Inviting: Take steps to make porches, patios and decks clean and inviting. This might include repairing wood decks and restaining them. If you can replace old furniture, it’s a great investment that you can take with you when you go.

- Stage the Yard: Just as you stage the inside of the home, it’s important to declutter and depersonalize your outside living area. You can leave furniture in neutral colors so that the buyer can imagine themselves in the space. However, bikes, kids’ toys and the rusted grill need to be stored out of site.

These basic ideas go a long way toward improving the curb appeal of your home. In return, you may be very happy with the positive effects on the sale of your home.

Your trusted real estate professional has many tips to make your home appealing to the most buyers. Communicate often with this valuable resource to ensure that you are set up to sell quickly.

Fixing up your home to sell doesn’t have to be a budget-breaker. You can revitalize the look of your property with a little bit of paint in the right places.

Fixing up your home to sell doesn’t have to be a budget-breaker. You can revitalize the look of your property with a little bit of paint in the right places. Members of the Federal Reserve’s Federal Open Market Committee voted to hold the target range of the federal funds rate to its current range of 2.25 to 2.50 percent. The minutes of the most recent Committee meeting cited softening domestic and global economic conditions as reason for not raising the target federal funds range.

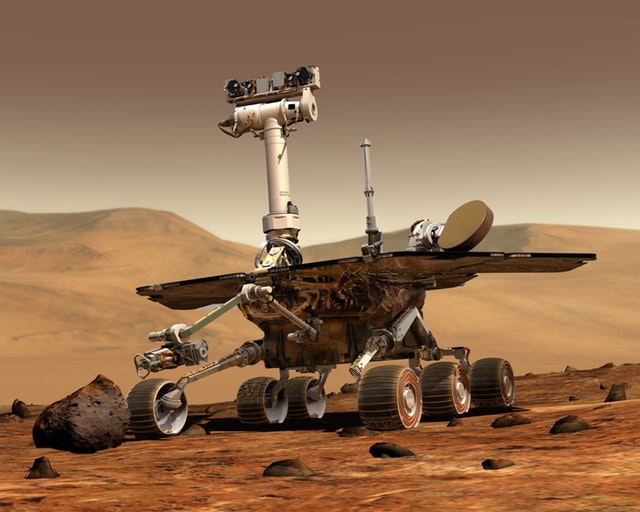

Members of the Federal Reserve’s Federal Open Market Committee voted to hold the target range of the federal funds rate to its current range of 2.25 to 2.50 percent. The minutes of the most recent Committee meeting cited softening domestic and global economic conditions as reason for not raising the target federal funds range. Real estate agents are constantly looking for new listings, which will attract potential buyers. We no longer need to limit our search for good listings to planet Earth because Mars is now for sale.

Real estate agents are constantly looking for new listings, which will attract potential buyers. We no longer need to limit our search for good listings to planet Earth because Mars is now for sale. The right home renovation strategy can increase property values and improve the comfort and utility of your space. However, your actions could have a harsh impact on our natural resources.

The right home renovation strategy can increase property values and improve the comfort and utility of your space. However, your actions could have a harsh impact on our natural resources. Are you planning on using a mortgage to help cover the cost of a new home? If so, you will want to prepare your finances and figure out how you will manage all those wallet-draining monthly expenses. Let’s take a look at how to run a quick financial health check to ensure you are ready to apply for a mortgage.

Are you planning on using a mortgage to help cover the cost of a new home? If so, you will want to prepare your finances and figure out how you will manage all those wallet-draining monthly expenses. Let’s take a look at how to run a quick financial health check to ensure you are ready to apply for a mortgage. Real estate isn’t a one-size-fits-all pursuit. Buying and renting multi-unit properties is one of the ways investors build residual income while increasing their property portfolios. However, multi-unit rentals come with some unique challenges. Are you ready to manage a multi-unit rental property?

Real estate isn’t a one-size-fits-all pursuit. Buying and renting multi-unit properties is one of the ways investors build residual income while increasing their property portfolios. However, multi-unit rentals come with some unique challenges. Are you ready to manage a multi-unit rental property? Perform roof maintenance on sunny days when there’s less chance of slipping. Blocking off a weekend twice a year gives you plenty of time to complete the items below without rushing or taking unnecessary risks. The beginning of spring and fall present the best opportunities to complete your maintenance before the weather turns too hot or too cold.

Perform roof maintenance on sunny days when there’s less chance of slipping. Blocking off a weekend twice a year gives you plenty of time to complete the items below without rushing or taking unnecessary risks. The beginning of spring and fall present the best opportunities to complete your maintenance before the weather turns too hot or too cold. Real estate investors sometimes get stuck in a rut. They repeat the same type of investment that they did before. This is not necessarily a bad thing because a successful experience is worth repeating. However, it is also a good idea to occasionally take a look at the big picture as well, to see what else is out there for investment consideration.

Real estate investors sometimes get stuck in a rut. They repeat the same type of investment that they did before. This is not necessarily a bad thing because a successful experience is worth repeating. However, it is also a good idea to occasionally take a look at the big picture as well, to see what else is out there for investment consideration. Home price indices issued by S&P Case-Shiller showed further slowing in home price growth in January. The national home price index showed 4.30 percent home price growth for the three months ended in January. Analysts expected home prices to grow 4.20 percent for the same period in cities surveyed by Case-Shiller. More cities reported declines in home prices than those that posted gains in home prices.

Home price indices issued by S&P Case-Shiller showed further slowing in home price growth in January. The national home price index showed 4.30 percent home price growth for the three months ended in January. Analysts expected home prices to grow 4.20 percent for the same period in cities surveyed by Case-Shiller. More cities reported declines in home prices than those that posted gains in home prices.