Talk to any homeowner, and they’ll probably tell you how excited they were when they first bought their home. After living there for a while, they’re likely to share some unexpected experiences — both pleasant and challenging. From embracing the freedom of owning their property and building memories to facing unexpected costs and endless maintenance tasks, homeownership is full of surprises.

Talk to any homeowner, and they’ll probably tell you how excited they were when they first bought their home. After living there for a while, they’re likely to share some unexpected experiences — both pleasant and challenging. From embracing the freedom of owning their property and building memories to facing unexpected costs and endless maintenance tasks, homeownership is full of surprises.

Here are some top surprises to expect:

1. The Amount of Maintenance Required

The most common surprise for first-time homeowners is the amount of maintenance required. From keeping the home functional to managing costs, maintenance can feel never-ending. Have a cash reserve for emergencies. Understand your home’s needs and your repair limits.

2. Changing Costs of Property Taxes and Insurance

Many buyers assume a fixed-rate mortgage means stable payments. However, property taxes and insurance, included in escrow, can fluctuate. Regularly review your escrow statement to understand how your mortgage payment is allocated.

3. Benefiting from Tax Write-Offs

You should not forget the tax benefits of homeownership. The big benefit is writing off interest on your taxes. Research tax benefits specific to homeowners to maximize your financial advantages.

4. Neighbors Impacting Quality of Life

The quality of life in your home can be significantly influenced by your neighbors. Check out and walk through the neighborhood and talk to them. Visit potential neighborhoods at different times to gauge the environment and noise levels.

5. Knowledge Required for Upkeep

As a homeowner, you’re responsible for all repairs. Consider the cost of utilities, tax bills, yard or pool upkeep, and potential hazards like lead paint. Thoroughly inspect the home before purchasing and budget for inevitable repairs.

6. Stability of Monthly Costs Despite Market Volatility

Most homes are a more stable investment than stocks. When the market goes down, you still have your home. Unlike cars and other assets, your home’s value goes up, not down.

7. External Factors Affecting Property

External factors like zoning rules and HOA regulations can limit what you do with your property. Research long-term plans for your area to avoid unwelcome surprises.

8. Scheduled Maintenance Needs

Regular maintenance is essential. Homeowners recommended servicing furnaces and air conditioners yearly and maintaining water heaters and septic systems. Keep a maintenance calendar to stay on top of necessary tasks.

9. Knowing Your Home’s Quirks

Understanding your home’s unique traits can prevent issues. Most homes will have unique sounds that are normal and some may be noises that need attention.

10. Attachment to Your Home

Home improvements and personal touches can create strong emotional ties. Keep in mind that you may fall in love with the place and have a hard time selling it.

Being a homeowner comes with its challenges and rewards. By understanding these surprises, you can be better prepared for the journey. Enjoy the satisfaction of knowing your home is truly yours.

When you’re selling your home, one crucial step in the process is the home appraisal. This evaluation plays a significant role in determining the sale price of your property. Here’s a guide to understanding home appraisals and their impact on your home sale:

When you’re selling your home, one crucial step in the process is the home appraisal. This evaluation plays a significant role in determining the sale price of your property. Here’s a guide to understanding home appraisals and their impact on your home sale: The generation, born between 1981 and 1996, known as Millennials is forced to face a complex landscape influenced by economic shifts, technological advancements, and changing societal norms. Here’s a closer look at the key hurdles and the potential bright spots for millennial homebuyers.

The generation, born between 1981 and 1996, known as Millennials is forced to face a complex landscape influenced by economic shifts, technological advancements, and changing societal norms. Here’s a closer look at the key hurdles and the potential bright spots for millennial homebuyers. Buying or selling real estate involves a lot of paperwork, and one of the most critical documents in these transactions is the deed. A deed is a legal document that transfers ownership of property from one party to another. Understanding the different types of deeds is essential to ensure you make informed decisions in your real estate transactions.

Buying or selling real estate involves a lot of paperwork, and one of the most critical documents in these transactions is the deed. A deed is a legal document that transfers ownership of property from one party to another. Understanding the different types of deeds is essential to ensure you make informed decisions in your real estate transactions. Multifamily residential buildings are at a greater risk for fire because they contain more kitchens, furnaces, water heaters, and other elements that can pose opportunities for a fire to start. Fire safety in multifamily housing is influenced by the design of the building, its fire protection features, the quality of materials used in the building’s construction, the building’s contents, and overall maintenance.

Multifamily residential buildings are at a greater risk for fire because they contain more kitchens, furnaces, water heaters, and other elements that can pose opportunities for a fire to start. Fire safety in multifamily housing is influenced by the design of the building, its fire protection features, the quality of materials used in the building’s construction, the building’s contents, and overall maintenance. Disclosures are a crucial aspect of the home-selling process. Though the disclosure form may appear lengthy and complex, it is essential to complete it accurately. Failure to disclose certain issues or providing false information can lead to legal repercussions, even after the sale is finalized.

Disclosures are a crucial aspect of the home-selling process. Though the disclosure form may appear lengthy and complex, it is essential to complete it accurately. Failure to disclose certain issues or providing false information can lead to legal repercussions, even after the sale is finalized. When shopping for a new home, it’s important to consider not just the aesthetics and location, but also the environmental impact of your future residence. Green features in homes are becoming increasingly popular, not only for their benefit to the environment but also for the cost savings they can provide over time. Here are some key green features to look for when buying a home:

When shopping for a new home, it’s important to consider not just the aesthetics and location, but also the environmental impact of your future residence. Green features in homes are becoming increasingly popular, not only for their benefit to the environment but also for the cost savings they can provide over time. Here are some key green features to look for when buying a home: Do you have a list of home projects you’ve been meaning to tackle? The good news: some of them can be done in just ten minutes! Here are five quick and easy tasks to help you get your home in order almost instantly.

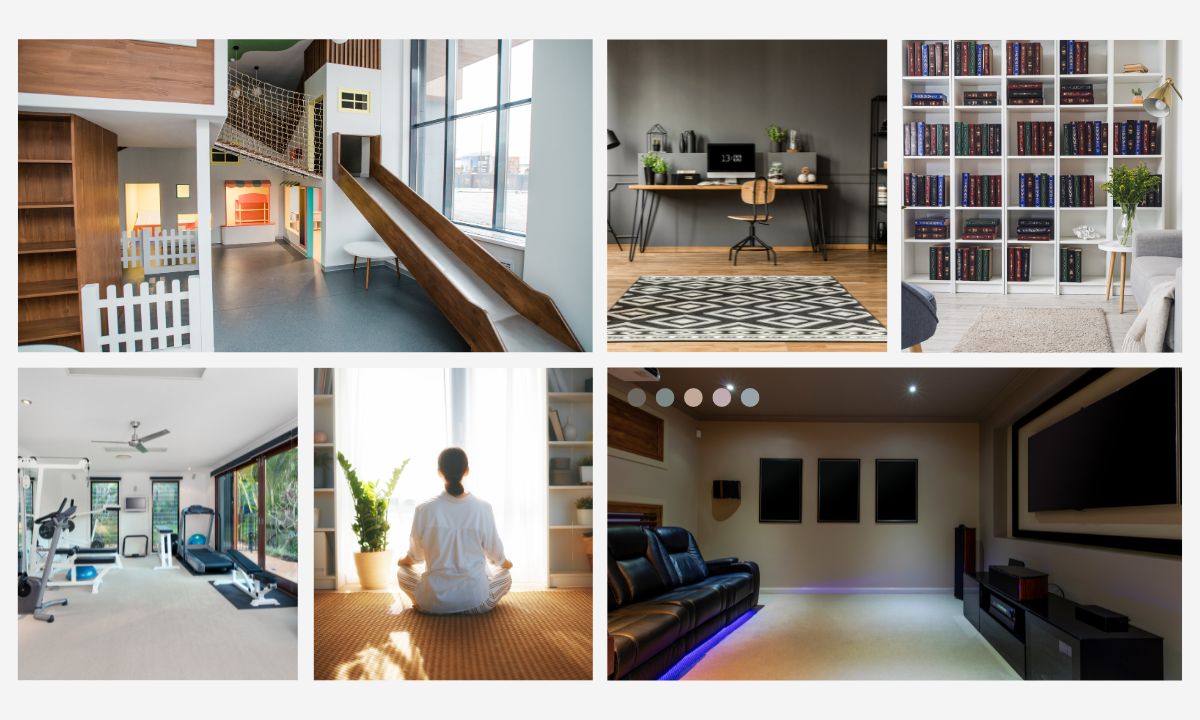

Do you have a list of home projects you’ve been meaning to tackle? The good news: some of them can be done in just ten minutes! Here are five quick and easy tasks to help you get your home in order almost instantly. Have you found yourself staring at that spare room wondering what to do with it? Whether it’s a small nook or a spacious area, there are endless possibilities to transform it into something that enhances your home life. Here are some inspiring ideas to help you make the most of that extra space:

Have you found yourself staring at that spare room wondering what to do with it? Whether it’s a small nook or a spacious area, there are endless possibilities to transform it into something that enhances your home life. Here are some inspiring ideas to help you make the most of that extra space: When it comes to buying a home, securing the right home loan is essential. But what determines how much you can borrow? Understanding the key factors that influence your borrowing power can help you make informed decisions and potentially increase the amount you can secure. Let’s explore these determinants and some actionable tips to maximize your borrowing power.

When it comes to buying a home, securing the right home loan is essential. But what determines how much you can borrow? Understanding the key factors that influence your borrowing power can help you make informed decisions and potentially increase the amount you can secure. Let’s explore these determinants and some actionable tips to maximize your borrowing power.