Whether you’re a buyer or a seller, a home appraisal is a critical component of the home selling process. An appraisal is also required in situations where a home is gifted to a family member, so it’s important to have a clear understanding of what it entails.

Whether you’re a buyer or a seller, a home appraisal is a critical component of the home selling process. An appraisal is also required in situations where a home is gifted to a family member, so it’s important to have a clear understanding of what it entails.

What Is A Home Appraisal?

A home appraisal is an unbiased estimate of a home’s fair market value conducted by a professional appraiser. All 50 states require that appraisers be licensed and/or certified and demonstrate knowledge of the specified area. The purpose of a home appraisal is to determine whether the home’s asking price is appropriate based on its location, condition, size, and amenities.

Appraisals are done in almost all purchase, sale and refinance transactions, with the exception being when a buyer uses cash and doesn’t have a mortgage. They are typically coordinated by the mortgage lender to ensure the loan isn’t too large in relation to the home’s value.

How Are Appraisal Values Determined?

Licensed appraisers calculate a home’s value based on comparable recent sales in the area and current market trends. Factors such as the home’s floor plan, size, number of rooms, and any upgrades or amenities are also considered. Upgrades and amenities could include things such as a pool, an expanded garage, or a remodeled kitchen.

The appraiser conducts a visual inspection to appraise a home, noting the home’s condition and whether any major repairs are needed. It’s important to note that this differs from a home inspection in that the appraisal assesses a home’s value, while an inspection assesses its condition. In an inspection, the home inspector actually makes repair recommendations. During an appraisal,the appraiser notes any necessary repairs but does not make recommendations.

When Is An Appraisal Done?

After an offer is made, an appraisal is one of the first steps in the closing process. Everything will proceed as planned as long as the appraisal value comes in at or above the price in the contract. If it appraises for below that amount, closing can be delayed or canceled altogether.

What Does A Home Appraisal Cost?

Costs vary based on the mortgage type, but a home appraisal generally costs $300-500. It is almost always paid for by the borrower as part of closing costs.

Those who are involved in the real estate industry likely know that mortgage rates are at an all-time low. At the same time, nobody wants to pay more for a house than they have to. Some of the most important factors that dictate how much someone is going to pay for a house include points and interest rates.

Those who are involved in the real estate industry likely know that mortgage rates are at an all-time low. At the same time, nobody wants to pay more for a house than they have to. Some of the most important factors that dictate how much someone is going to pay for a house include points and interest rates. There are lots of people out there who are searching for options for mortgage relief. A quick search will reveal options for programs such as FMERR and HARP; however, many of the articles regarding these programs are a bit outdated. This makes them misleading. Sometimes, people might think they can apply for these programs when, in reality, they cannot. These programs have expired. Fortunately, there is another option for HIRO.

There are lots of people out there who are searching for options for mortgage relief. A quick search will reveal options for programs such as FMERR and HARP; however, many of the articles regarding these programs are a bit outdated. This makes them misleading. Sometimes, people might think they can apply for these programs when, in reality, they cannot. These programs have expired. Fortunately, there is another option for HIRO. There are a lot of people who enjoy working from home; however, with the COVID-19 pandemic, many people who are not used to working from home are forced into this new arrangement. It can be hard for individuals o stay focused when they are stuck in the environment at home. Particularly if the kids are home from school, it is easy to get distracted. Fortunately, there are a few ways people can retain their sanity as they work from home.

There are a lot of people who enjoy working from home; however, with the COVID-19 pandemic, many people who are not used to working from home are forced into this new arrangement. It can be hard for individuals o stay focused when they are stuck in the environment at home. Particularly if the kids are home from school, it is easy to get distracted. Fortunately, there are a few ways people can retain their sanity as they work from home. Individuals who own their homes with a considerable amount of equity should consider looking into proprietary jumbo reverse mortgages. These can be helpful tools that may allow seniors to either pay down an existing mortgage or fund their retirement.

Individuals who own their homes with a considerable amount of equity should consider looking into proprietary jumbo reverse mortgages. These can be helpful tools that may allow seniors to either pay down an existing mortgage or fund their retirement.  Millennials are the first generation in America that will probably not be able to do as well as their parents. In the United States, there is not as much upward mobility as there was in the past. What is the cause of this?

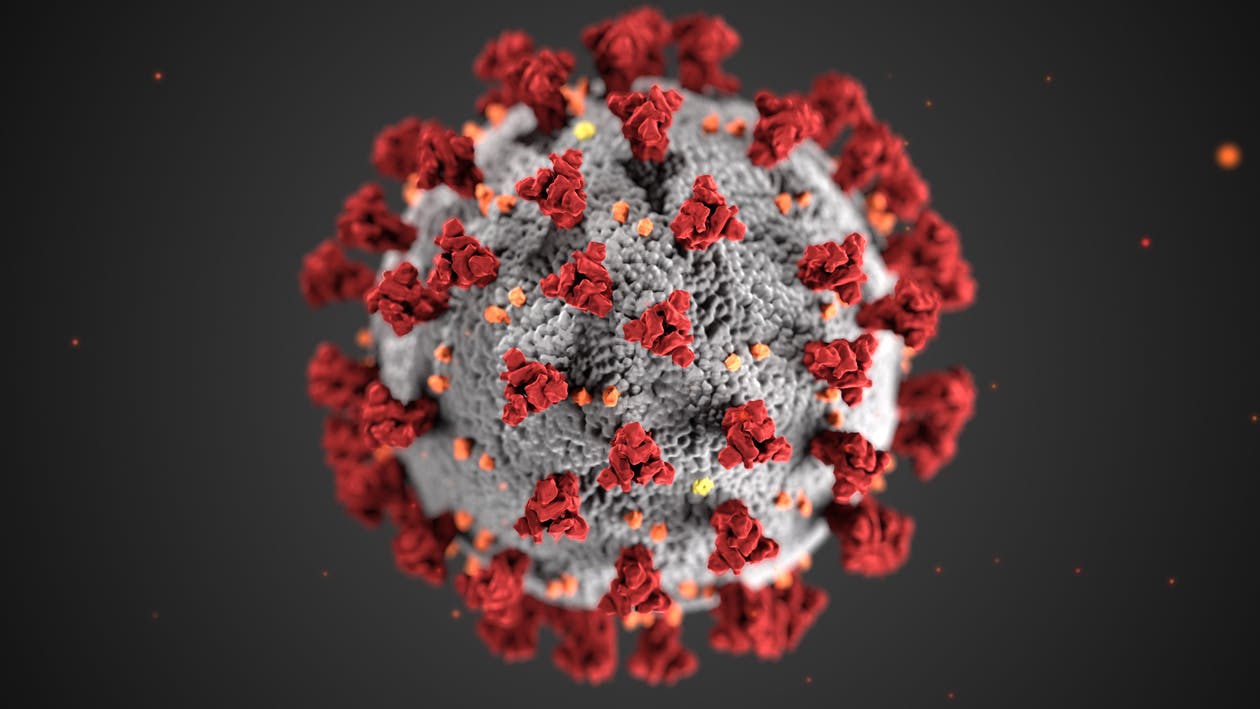

Millennials are the first generation in America that will probably not be able to do as well as their parents. In the United States, there is not as much upward mobility as there was in the past. What is the cause of this? If you have paid attention to the news recently, you have probably heard about the coronavirus pandemic which also goes by the name COVID-19. Those who are exposed to the virus might be asked to place themselves in quarantine. Some states have even told their residents to shelter in place. While this infection has forced everyone to change the way they live their lives, there are still some home improvement projects you can tackle during quarantine to put your free time to use.

If you have paid attention to the news recently, you have probably heard about the coronavirus pandemic which also goes by the name COVID-19. Those who are exposed to the virus might be asked to place themselves in quarantine. Some states have even told their residents to shelter in place. While this infection has forced everyone to change the way they live their lives, there are still some home improvement projects you can tackle during quarantine to put your free time to use. It can be a tremendous challenge to suddenly be stuck at home during the COVID-19 crisis. For those who are in an area of the country where there is a “shelter in place” order, this can feel very much like house arrest. If there are children stuck at home as well, this could be enough to make the entire family go stir crazy.

It can be a tremendous challenge to suddenly be stuck at home during the COVID-19 crisis. For those who are in an area of the country where there is a “shelter in place” order, this can feel very much like house arrest. If there are children stuck at home as well, this could be enough to make the entire family go stir crazy. By now, it should be apparent that this COVID-19 (Corona-virus) pandemic is going to be here for several months. It is already causing the market to plummet and is disrupting jobs all over the country. Many people who work as hourly employees (or are independent contractors) are starting to suffer. As people’s budgets start to feel the squeeze, this is exactly the time that people should be relying on an emergency fund; however, for those who don’t have one, it is time to start saving.

By now, it should be apparent that this COVID-19 (Corona-virus) pandemic is going to be here for several months. It is already causing the market to plummet and is disrupting jobs all over the country. Many people who work as hourly employees (or are independent contractors) are starting to suffer. As people’s budgets start to feel the squeeze, this is exactly the time that people should be relying on an emergency fund; however, for those who don’t have one, it is time to start saving. Federal housing agencies and government-sponsored enterprises Fannie Mae and Freddie Mac are responding to the COVID-19 outbreak with multiple relief programs for homeowners experiencing hardship due to illness and job loss.

Federal housing agencies and government-sponsored enterprises Fannie Mae and Freddie Mac are responding to the COVID-19 outbreak with multiple relief programs for homeowners experiencing hardship due to illness and job loss.