When buying or selling a home, a crucial step in the process is the home appraisal. It helps determine the property’s fair market value, which can significantly influence financing and negotiation outcomes. Whether you’re a first-time homebuyer or a seasoned seller, understanding the appraisal process is key. Here are seven commonly asked questions about home appraisals to guide you through.

When buying or selling a home, a crucial step in the process is the home appraisal. It helps determine the property’s fair market value, which can significantly influence financing and negotiation outcomes. Whether you’re a first-time homebuyer or a seasoned seller, understanding the appraisal process is key. Here are seven commonly asked questions about home appraisals to guide you through.

1. What is a Home Appraisal? A home appraisal is an unbiased estimate of a property’s value conducted by a licensed appraiser. Lenders require an appraisal to ensure the home is worth the loan amount being requested. The appraiser assesses factors like the home’s condition, location, and comparable sales in the area to determine its value.

2. Who Pays for the Appraisal? Typically, the buyer is responsible for paying the appraisal fee, which is often included in the closing costs. However, in some cases, the seller might cover the cost as part of the negotiation. The fee can vary depending on the property’s location and size but generally ranges between $300 and $600.

3. How Long Does an Appraisal Take? The appraisal process can take anywhere from a few days to a week. The appraiser will visit the property, take notes, and compare it with similar homes in the area. After the visit, the appraiser compiles the information into a report, which is then submitted to the lender.

4. What Factors Affect the Appraisal Value? Several factors influence the appraisal value of a home, including:

- Location: Proximity to schools, parks, and amenities can boost value.

- Size: Larger homes generally appraise for more.

- Condition: Updated, well-maintained properties are valued higher.

- Market Trends: Current real estate market conditions in the area also play a role.

5. What Happens if the Appraisal is Lower Than the Offer? If the appraisal comes in lower than the agreed-upon sale price, it can complicate the transaction. The buyer may need to renegotiate the price with the seller, come up with additional funds to cover the difference, or in some cases, the deal might fall through.

6. Can You Challenge a Low Appraisal? Yes, it’s possible to challenge a low appraisal, but it can be a complex process. The buyer or seller would need to provide evidence that the appraiser overlooked key aspects of the property or made errors in their report. This might involve presenting comparable sales that were not considered in the original appraisal.

7. Do Renovations Increase Appraisal Value? Renovations can increase a home’s appraised value, particularly if they improve the property’s functionality or appeal. Kitchens, bathrooms, and curb appeal upgrades tend to yield the highest return on investment. However, not all renovations guarantee a higher appraisal, so it’s essential to understand which improvements are most valued in your market.

Understanding the home appraisal process can help you navigate your real estate transaction more effectively. By knowing what to expect and how to address potential issues, you can ensure that the appraisal aligns with your goals and helps move the process forward smoothly.

Homes & Real Estate

Homes & Real Estate Mold—it’s a word that can send shivers down the spine of any prospective homeowner. But what happens when an inspector discovers mold in your dream home? Does it mean the deal is off, or are there steps you can take to remedy the situation without walking away? Here’s a guide to help you navigate this common yet serious issue.

Mold—it’s a word that can send shivers down the spine of any prospective homeowner. But what happens when an inspector discovers mold in your dream home? Does it mean the deal is off, or are there steps you can take to remedy the situation without walking away? Here’s a guide to help you navigate this common yet serious issue. Taxes & Homeownership

Taxes & Homeownership Congratulations! You’ve found your dream home! The only problem? Someone else found it first, and now the property is marked as “sale pending.” Does this mean you’ve missed your chance, or can you still make an offer? Let’s discuss what “sale pending” means and explore the options that might still be available to you.

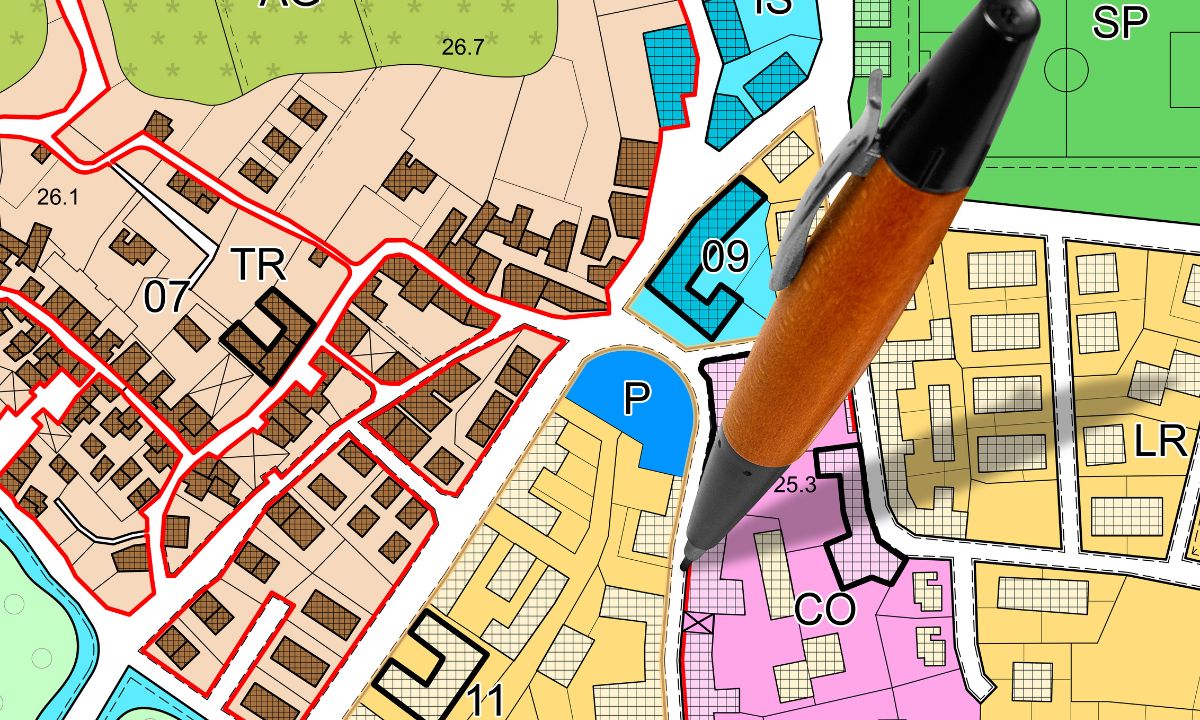

Congratulations! You’ve found your dream home! The only problem? Someone else found it first, and now the property is marked as “sale pending.” Does this mean you’ve missed your chance, or can you still make an offer? Let’s discuss what “sale pending” means and explore the options that might still be available to you. Purchasing a home is an exciting milestone, but it’s important to be aware of the various factors that can influence your decision. One often overlooked yet crucial aspect is understanding zoning laws and regulations. These rules can significantly impact your property rights and the future use of your home. We will discuss what zoning laws are, why they matter, and how they can affect your homebuying experience.

Purchasing a home is an exciting milestone, but it’s important to be aware of the various factors that can influence your decision. One often overlooked yet crucial aspect is understanding zoning laws and regulations. These rules can significantly impact your property rights and the future use of your home. We will discuss what zoning laws are, why they matter, and how they can affect your homebuying experience. Transitioning from renting to homeownership is an exciting and significant milestone in anyone’s life. This journey, while thrilling, can also be filled with questions and uncertainties. As your trusted real estate agent, I am here to guide you through this process, ensuring a smooth and successful transition. We will discuss the steps you need to take to move from being a renter to a proud homeowner.

Transitioning from renting to homeownership is an exciting and significant milestone in anyone’s life. This journey, while thrilling, can also be filled with questions and uncertainties. As your trusted real estate agent, I am here to guide you through this process, ensuring a smooth and successful transition. We will discuss the steps you need to take to move from being a renter to a proud homeowner. Selling your home is an exciting journey, but receiving a lowball offer can feel like a setback. While it might be tempting to reject such offers outright, handling them with patience and strategy can often lead to a better outcome. Here’s how to effectively manage lowball offers on your home.

Selling your home is an exciting journey, but receiving a lowball offer can feel like a setback. While it might be tempting to reject such offers outright, handling them with patience and strategy can often lead to a better outcome. Here’s how to effectively manage lowball offers on your home. Planning for retirement is an essential aspect of securing a comfortable and financially stable future. While traditional retirement accounts and investments play a significant role, incorporating real estate into your retirement plan can provide additional benefits and opportunities for growth. Here’s how real estate can be a valuable component of your retirement strategy and some tips to help you build a strong financial future.

Planning for retirement is an essential aspect of securing a comfortable and financially stable future. While traditional retirement accounts and investments play a significant role, incorporating real estate into your retirement plan can provide additional benefits and opportunities for growth. Here’s how real estate can be a valuable component of your retirement strategy and some tips to help you build a strong financial future. In recent months, the real estate market has been a whirlwind of activity, with home prices steadily climbing and buyer demand outpacing available inventory. This dynamic landscape presents a crucial question for prospective homebuyers: is waiting to purchase a home a wise decision, or could it cost more in the long run?

In recent months, the real estate market has been a whirlwind of activity, with home prices steadily climbing and buyer demand outpacing available inventory. This dynamic landscape presents a crucial question for prospective homebuyers: is waiting to purchase a home a wise decision, or could it cost more in the long run?