The generation, born between 1981 and 1996, known as Millennials is forced to face a complex landscape influenced by economic shifts, technological advancements, and changing societal norms. Here’s a closer look at the key hurdles and the potential bright spots for millennial homebuyers.

The generation, born between 1981 and 1996, known as Millennials is forced to face a complex landscape influenced by economic shifts, technological advancements, and changing societal norms. Here’s a closer look at the key hurdles and the potential bright spots for millennial homebuyers.

Challenges

1. Student Loan Debt Many millennials are burdened with substantial student loan debt, which affects their ability to save for a down payment and qualify for a mortgage. The average millennial carries around $33,000 in student loan debt, making homeownership seem like a distant dream for many.

2. Rising Home Prices The real estate market has seen significant appreciation in home values, especially in urban areas where many millennials prefer to live. This surge in prices often outpaces wage growth, making it harder for first-time buyers to enter the market.

3. High Competition The demand for housing often outstrips supply, leading to intense competition. Millennials frequently find themselves in bidding wars, which can drive up prices and make it difficult to secure a property.

4. Credit Challenges Building a solid credit profile takes time, and many millennials face hurdles in this area. Without a strong credit score, securing favorable mortgage terms can be challenging, adding another layer of difficulty to the home-buying process.

Opportunities

1. Technological Advancements Millennials are tech-savvy and can leverage various online tools and apps to simplify the home-buying process. Virtual tours, real estate apps, and online mortgage calculators provide valuable resources that were not available to previous generations.

2. Flexible Work Arrangements The rise of remote work and flexible job arrangements means millennials have more options when choosing where to live. They are no longer tied to specific locations for their careers, allowing them to explore more affordable housing markets.

3. Government Programs There are numerous federal, state, and local programs designed to assist first-time homebuyers. These programs offer benefits such as lower down payments, reduced interest rates, and grants that can make purchasing a home more accessible.

4. Growing Real Estate Knowledge Millennials are often more informed about the real estate market thanks to the wealth of information available online. They can access data on market trends, property values, and neighborhood insights, empowering them to make more educated decisions.

Tips for Millennial Homebuyers

1. Start Saving Early Even small, consistent savings can add up over time. Consider setting up a dedicated savings account for your down payment and explore options like high-yield savings accounts or investment accounts.

2. Improve Your Credit Score Pay off existing debts, make timely payments, and avoid taking on new credit obligations. These steps can help boost your credit score, making it easier to qualify for favorable mortgage terms.

3. Get Pre-Approved for a Mortgage A pre-approval letter can give you a competitive edge in the market. It shows sellers that you are a serious buyer with the financial backing to complete the purchase.

4. Work with a Knowledgeable Real Estate Agent An experienced real estate agent can provide valuable insights, negotiate on your behalf, and guide you through the complex process of buying a home. Their expertise can be particularly beneficial in a competitive market.

5. Be Open to Different Locations Expanding your search to different neighborhoods or even cities can open up more affordable housing options. Don’t limit yourself to one area; explore various locations to find the best fit for your budget and lifestyle.

The real estate market as a millennial comes with its set of challenges, but with the right approach and resources, homeownership can be an attainable goal. By leveraging technology, improving financial health, and staying informed, millennials can find their dream home and build a solid foundation for the future.

Buying a home is a significant investment, and ensuring the property is in good condition is crucial. There are times when asking the seller for repairs is the best course of action, but in other situations, requesting a credit may be more beneficial. Understanding when to choose each option can help you navigate the buying process more effectively.

Buying a home is a significant investment, and ensuring the property is in good condition is crucial. There are times when asking the seller for repairs is the best course of action, but in other situations, requesting a credit may be more beneficial. Understanding when to choose each option can help you navigate the buying process more effectively. Buying or selling real estate involves a lot of paperwork, and one of the most critical documents in these transactions is the deed. A deed is a legal document that transfers ownership of property from one party to another. Understanding the different types of deeds is essential to ensure you make informed decisions in your real estate transactions.

Buying or selling real estate involves a lot of paperwork, and one of the most critical documents in these transactions is the deed. A deed is a legal document that transfers ownership of property from one party to another. Understanding the different types of deeds is essential to ensure you make informed decisions in your real estate transactions. When it comes to constructing your house or undertaking home improvement projects, the roof is a crucial component. It’s not just about aesthetics; the roof provides essential protection against the elements. Investing both money and time into selecting the right roofing material is vital, and a little extra research can go a long way.

When it comes to constructing your house or undertaking home improvement projects, the roof is a crucial component. It’s not just about aesthetics; the roof provides essential protection against the elements. Investing both money and time into selecting the right roofing material is vital, and a little extra research can go a long way. Multifamily residential buildings are at a greater risk for fire because they contain more kitchens, furnaces, water heaters, and other elements that can pose opportunities for a fire to start. Fire safety in multifamily housing is influenced by the design of the building, its fire protection features, the quality of materials used in the building’s construction, the building’s contents, and overall maintenance.

Multifamily residential buildings are at a greater risk for fire because they contain more kitchens, furnaces, water heaters, and other elements that can pose opportunities for a fire to start. Fire safety in multifamily housing is influenced by the design of the building, its fire protection features, the quality of materials used in the building’s construction, the building’s contents, and overall maintenance.

Disclosures are a crucial aspect of the home-selling process. Though the disclosure form may appear lengthy and complex, it is essential to complete it accurately. Failure to disclose certain issues or providing false information can lead to legal repercussions, even after the sale is finalized.

Disclosures are a crucial aspect of the home-selling process. Though the disclosure form may appear lengthy and complex, it is essential to complete it accurately. Failure to disclose certain issues or providing false information can lead to legal repercussions, even after the sale is finalized. Selling your house can be both exciting and daunting, especially when you receive offers from potential buyers. It’s essential to evaluate each offer carefully to ensure you’re making the right decision. Here are three key factors to consider when evaluating an offer on your home:

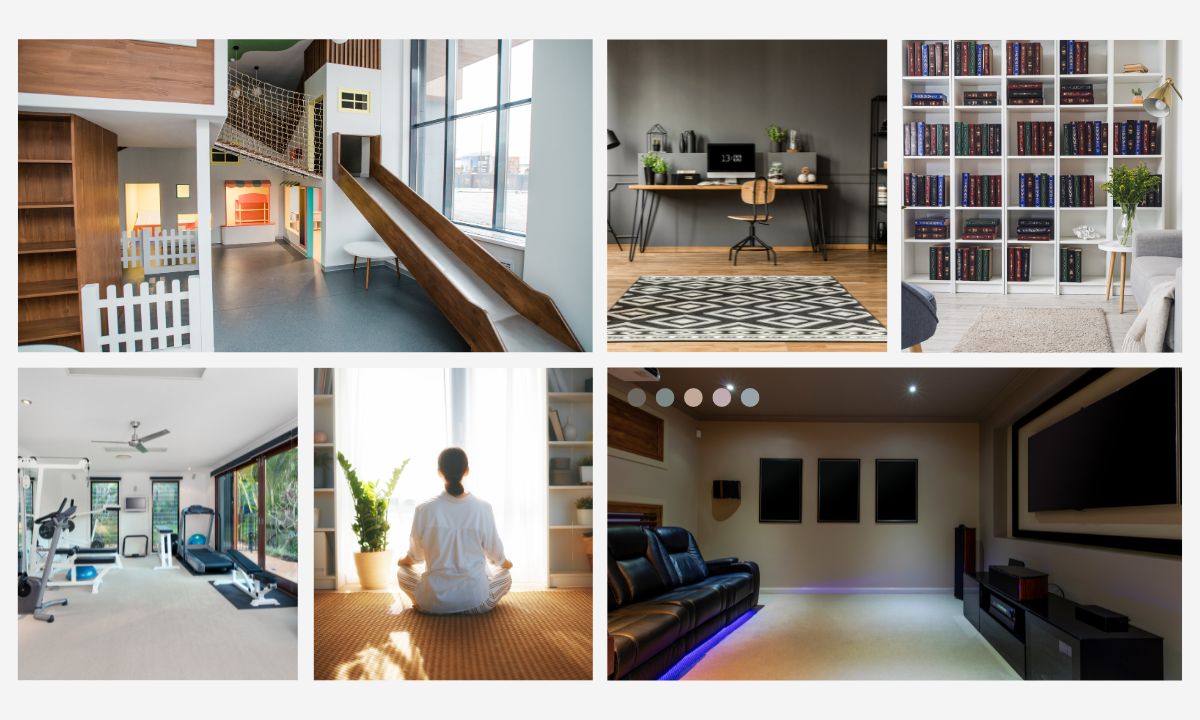

Selling your house can be both exciting and daunting, especially when you receive offers from potential buyers. It’s essential to evaluate each offer carefully to ensure you’re making the right decision. Here are three key factors to consider when evaluating an offer on your home: Have you found yourself staring at that spare room wondering what to do with it? Whether it’s a small nook or a spacious area, there are endless possibilities to transform it into something that enhances your home life. Here are some inspiring ideas to help you make the most of that extra space:

Have you found yourself staring at that spare room wondering what to do with it? Whether it’s a small nook or a spacious area, there are endless possibilities to transform it into something that enhances your home life. Here are some inspiring ideas to help you make the most of that extra space: Navigating the real estate market can be challenging, especially with all the industry-specific terms that get tossed around. Two phrases you’re likely to encounter are “pending” and “under contract.” While they might seem similar at first glance, they represent different stages of the home-buying process. Let’s break down what each term means and how they impact your home-buying or selling journey.

Navigating the real estate market can be challenging, especially with all the industry-specific terms that get tossed around. Two phrases you’re likely to encounter are “pending” and “under contract.” While they might seem similar at first glance, they represent different stages of the home-buying process. Let’s break down what each term means and how they impact your home-buying or selling journey.