Savvy home buyers often get great deals on new home constructions by asking for deals and discounts and doing some up-front research.

Savvy home buyers often get great deals on new home constructions by asking for deals and discounts and doing some up-front research.

Home builders often dislike offering steep discounts in sales prices because they want everyone in the community to feel like they bought their property at a fair price. Maintaining sales prices also helps with future home appraisal values. It helps all of the buyers in a neighborhood to keep sales prices consistent and growing.

Fortunately, you can still get great discounts that can reduce the cost of your new home.

Ask the builder if they can do the following:

Settle Closing Costs

Closing costs vary depending on your state. On average, the costs can be as high as $10,000. In Colorado, for example, a standard closing is about 3 percent of the selling price.

It’s important to note that closing costs vary widely and can be structured in many ways. Make sure to consult a trusted mortgage finance professional to get the best information on your situation. But if the builder pays the bill, that money remains in your pocket. Isn’t that a great discount?

Buy Down Your Interest Rate

Although interest rates are low, if a builder is willing to buy down your rate further as part of the closing, it would reduce the amount you pay monthly in interest on your mortgage payment. That makes it manageable in the long run. Once again, your mortgage professional can give you the best details on this idea.

Offer Free Upgrades

Most homes have standard built in appliances. To get high-end appliances, home buyers normally have to pay for upgrades. Ask your builder if you can get the upgraded home appliances or other upgrades without paying extra. It’s a great strategy to move into an improved new home.

Additional Discounts

To sweeten the deal, home builders can throw in additional discounts such as automated garage doors, landscaping, finished basements and window coverings. These discounts are worth asking about.

Although these strategies are great, there are some situations that make it more difficult to get sales concessions. Therefore, as you negotiate, keep the following in mind:

- If business is going great, deals become more unlikely as builders have little motivation to give discounts.

- You may not end up with the perfect home you want since you may be buying a home that’s near completion or already built.

- The best home locations may be taken because properties in prime lots are usually the first to sell.

Knowledgeable buyers are most capable to cut great deals. Therefore, research new construction homes in your preferred neighborhood, visit some homes and compare what deals you can get. Above all, don’t hesitate to ask questions of your trusted real estate and mortgage professionals.

The Tax Cuts and Jobs Act of 2017 instituted some of the most dramatic changes to the financial landscape in the United States in over 30 years. These adjustments to the IRS code have an effect on everyone who earns and spends money in this country.

The Tax Cuts and Jobs Act of 2017 instituted some of the most dramatic changes to the financial landscape in the United States in over 30 years. These adjustments to the IRS code have an effect on everyone who earns and spends money in this country. With the right combination of strategy, knowledge, and luck, flipping houses can create big profits for short-term investors. However, your path to success starts at your first auction.

With the right combination of strategy, knowledge, and luck, flipping houses can create big profits for short-term investors. However, your path to success starts at your first auction. These days, people want energy-efficient homes that look great. To answer the call of passionate environmentalists, developer are rising to the occasion and designing home features that minimize waste, save energy and reuse reclaimed materials. The results are gorgeous, green homes that help move the sustainable living trend forward.

These days, people want energy-efficient homes that look great. To answer the call of passionate environmentalists, developer are rising to the occasion and designing home features that minimize waste, save energy and reuse reclaimed materials. The results are gorgeous, green homes that help move the sustainable living trend forward. One thing to think about when purchasing a home or parcel of land is to have an updated land survey conducted. While property deeds generally include detailed information, many are outdated for a variety of reasons that include nature, weather conditions, and adjustments in floodplain maps among others.

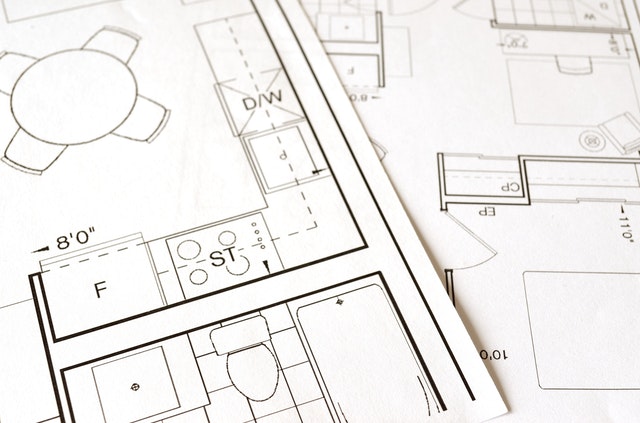

One thing to think about when purchasing a home or parcel of land is to have an updated land survey conducted. While property deeds generally include detailed information, many are outdated for a variety of reasons that include nature, weather conditions, and adjustments in floodplain maps among others. A home is one of the biggest investments you can make, and the American Dream for many. Most people spend significant time finding or designing their “dream home.” The first decision is whether to buy or build.

A home is one of the biggest investments you can make, and the American Dream for many. Most people spend significant time finding or designing their “dream home.” The first decision is whether to buy or build.  A title search is an early warning system for buyers and lenders. It reveals flaws the owner must resolve prior to a closing or refinance request. This allows the owner to clear any issues on the title so that the process can move forward. Also, it protects the buyer or lender from assuming an obligation they aren’t responsible for.

A title search is an early warning system for buyers and lenders. It reveals flaws the owner must resolve prior to a closing or refinance request. This allows the owner to clear any issues on the title so that the process can move forward. Also, it protects the buyer or lender from assuming an obligation they aren’t responsible for.  Buying your home can be nerve-racking, especially if it’s the first time. The buying process is exciting and often complex. The chances of making a mistake are relatively high.

Buying your home can be nerve-racking, especially if it’s the first time. The buying process is exciting and often complex. The chances of making a mistake are relatively high.  When you make an offer on a home, you wait anxiously to see if it will be accepted. Sometimes you’re lucky enough to hear back within hours. Other times you could wait days or even weeks.

When you make an offer on a home, you wait anxiously to see if it will be accepted. Sometimes you’re lucky enough to hear back within hours. Other times you could wait days or even weeks. Atlanta, Charlotte, New York and Los Angeles are always on the real estate radar because of big ticket sales and good media coverage. The secondary markets – those markets without the celebrity undertones – may actually be better deals. With the price of borrowing money rising and occupation rates dropping in primary markets, places like Nashville and Birmingham are looking better to investors.

Atlanta, Charlotte, New York and Los Angeles are always on the real estate radar because of big ticket sales and good media coverage. The secondary markets – those markets without the celebrity undertones – may actually be better deals. With the price of borrowing money rising and occupation rates dropping in primary markets, places like Nashville and Birmingham are looking better to investors.