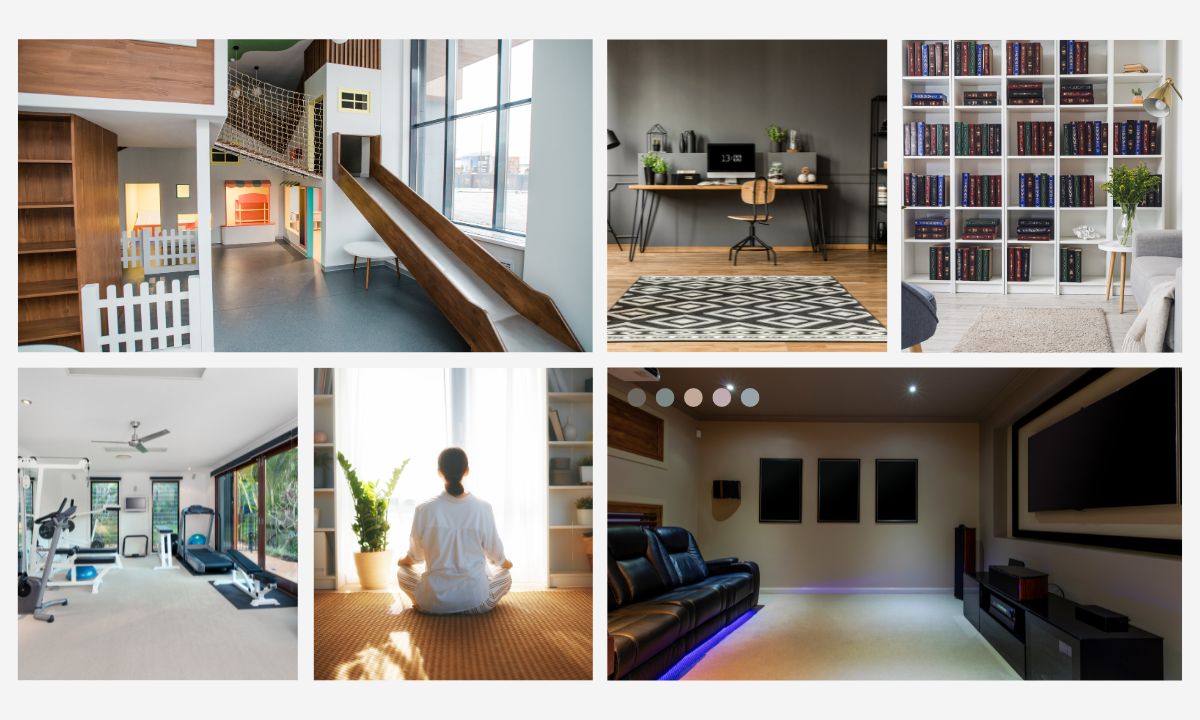

Have you found yourself staring at that spare room wondering what to do with it? Whether it’s a small nook or a spacious area, there are endless possibilities to transform it into something that enhances your home life. Here are some inspiring ideas to help you make the most of that extra space:

Have you found yourself staring at that spare room wondering what to do with it? Whether it’s a small nook or a spacious area, there are endless possibilities to transform it into something that enhances your home life. Here are some inspiring ideas to help you make the most of that extra space:

1. Playroom for the Little Ones:

Why not create a vibrant playroom where your kids can unleash their creativity and energy? Fill it with colorful mats, storage bins for toys, and maybe even a mini-table for arts and crafts. It’s a win-win: a space for them to play freely and a tidy home for you!

2. Study or Home Office:

In need of a quiet place to focus? Transform your spare room into a sleek home office or study. A sturdy desk, ergonomic chair, and good lighting can turn this space into your productivity hub. Add bookshelves or a filing cabinet for organization and you are done!

3. Gym to Stay Fit:

No need for a gym membership when you have your own fitness space at home! Equip the room with exercise mats, dumbbells, a workout bench, and maybe even a treadmill or stationary bike. This setup will motivate you to stay active without leaving the comfort of your home.

4. Meditation and Relaxation Room:

Create a serene oasis for relaxation and mindfulness. Soft rugs, floor cushions, and soothing decor like candles or plants can transform this room into your sanctuary. Add a small altar or a meditation cushion for moments of peace and reflection.

5. Entertainment Room:

Love movie nights or hosting game evenings? Turn your spare room into an entertainment hub! Install a big-screen TV, comfy seating (bean bags or recliners work great), and shelves for your movie collection or board games. It’s perfect for family gatherings or chilling out with friends.

Each of these ideas can be customized to fit your family’s needs and interests. So go ahead, let your creativity flow, and transform that extra room into a space that enhances your home and lifestyle!

Fix-and-flip projects can be lucrative endeavors for real estate investors, but they often require a significant upfront investment. One key financial tool that savvy investors use to fund these projects is a construction loan. We will examine how you can leverage construction loans to maximize your profits in the fix-and-flip game.

Fix-and-flip projects can be lucrative endeavors for real estate investors, but they often require a significant upfront investment. One key financial tool that savvy investors use to fund these projects is a construction loan. We will examine how you can leverage construction loans to maximize your profits in the fix-and-flip game. Welcome to the world of home renovation, where dreams meet reality and your property’s potential is waiting to be unleashed. If you’re contemplating a home renovation project, you’re likely wondering which upgrades will not only enhance your living space but also add significant value to your property. In this blog post, we’ll explore the top home renovations that provide the best return on investment (ROI), helping you make informed decisions and turn your home into a valuable asset.

Welcome to the world of home renovation, where dreams meet reality and your property’s potential is waiting to be unleashed. If you’re contemplating a home renovation project, you’re likely wondering which upgrades will not only enhance your living space but also add significant value to your property. In this blog post, we’ll explore the top home renovations that provide the best return on investment (ROI), helping you make informed decisions and turn your home into a valuable asset. Home renovations can be an effective way to protect your home and family from natural hazards. Start by identifying the potential hazards in your area. This can include natural disasters such as earthquakes, hurricanes, floods, wildfires, and tornadoes, as well as man-made hazards such as gas leaks and fires. Once you’ve identified the potential hazards in your area, create a plan for how you will respond to them and prepare your home to take on these natural disasters and keep your home and family safe.

Home renovations can be an effective way to protect your home and family from natural hazards. Start by identifying the potential hazards in your area. This can include natural disasters such as earthquakes, hurricanes, floods, wildfires, and tornadoes, as well as man-made hazards such as gas leaks and fires. Once you’ve identified the potential hazards in your area, create a plan for how you will respond to them and prepare your home to take on these natural disasters and keep your home and family safe. The bathroom is one of the most important and frequently used spaces in a home. Over time, it may start to show signs of wear and tear or become outdated. If you’re considering renovating your bathroom, one of the first decisions you’ll face is whether to tackle the project yourself or hire a professional. Both options have their pros and cons, and it’s essential to weigh them carefully before deciding.

The bathroom is one of the most important and frequently used spaces in a home. Over time, it may start to show signs of wear and tear or become outdated. If you’re considering renovating your bathroom, one of the first decisions you’ll face is whether to tackle the project yourself or hire a professional. Both options have their pros and cons, and it’s essential to weigh them carefully before deciding. The housing market continues to be very competitive, so you may have to be a bit more flexible with what you are looking for. For example, you may come across a home that is not quite perfect, but it has a lot of the features that you need. In that case, you may be wondering how you can finance a home renovation. One of the best ways to do so is using the FHA Streamline 203(k) program.

The housing market continues to be very competitive, so you may have to be a bit more flexible with what you are looking for. For example, you may come across a home that is not quite perfect, but it has a lot of the features that you need. In that case, you may be wondering how you can finance a home renovation. One of the best ways to do so is using the FHA Streamline 203(k) program.  It is not exactly a secret that inflation is a significant issue. With inflation continuing to increase the cost of living all over the world, there are many people who are looking for ways to save money. Home improvement and renovation projects have been popular during the past few years, but many homeowners are starting to put them on hold because of how expensive everything has gotten. What are some of the ways you can save money on your home repair and renovation costs?

It is not exactly a secret that inflation is a significant issue. With inflation continuing to increase the cost of living all over the world, there are many people who are looking for ways to save money. Home improvement and renovation projects have been popular during the past few years, but many homeowners are starting to put them on hold because of how expensive everything has gotten. What are some of the ways you can save money on your home repair and renovation costs? When people are looking for a home, they are often looking for something that is move-in ready. While this might make the process easier, this can also make the home much more expensive. It is still possible to find a dream home even if the house requires a bit of renovation. This is also a great opportunity for homeowners to customize the home to meet their needs. What do potential homeowners need to know about taking out a mortgage to renovate a fixer-upper when compared to a conventional home loan? Take a look at some helpful information below.

When people are looking for a home, they are often looking for something that is move-in ready. While this might make the process easier, this can also make the home much more expensive. It is still possible to find a dream home even if the house requires a bit of renovation. This is also a great opportunity for homeowners to customize the home to meet their needs. What do potential homeowners need to know about taking out a mortgage to renovate a fixer-upper when compared to a conventional home loan? Take a look at some helpful information below. If you have been spending a lot of time at home recently, then you might be getting tired of staring at the same four walls. Fortunately, there are plenty of ways for you to switch it up by financing a home improvement project. At the same time, home improvement projects can be expensive, particularly if you are targeting the kitchen. Therefore, you might be wondering how you are going to be able to pay for them. There are plenty of ways that you can finance a home improvement project, so take a look at a few of the options below.

If you have been spending a lot of time at home recently, then you might be getting tired of staring at the same four walls. Fortunately, there are plenty of ways for you to switch it up by financing a home improvement project. At the same time, home improvement projects can be expensive, particularly if you are targeting the kitchen. Therefore, you might be wondering how you are going to be able to pay for them. There are plenty of ways that you can finance a home improvement project, so take a look at a few of the options below.  Millennials are among the most common demographic buying homes today. According to numerous reports that have been published, many homeowners are planning on conducting a home improvement project this year. In large part, this is due to millennials wanting to improve their homes.

Millennials are among the most common demographic buying homes today. According to numerous reports that have been published, many homeowners are planning on conducting a home improvement project this year. In large part, this is due to millennials wanting to improve their homes.